Foot Locker 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

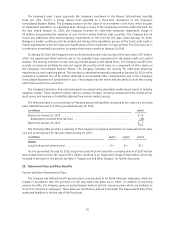

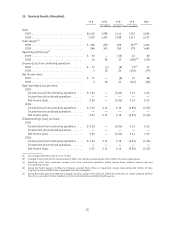

The information set forth in the following table covers options granted under the Company’s stock option

plans: 2009 2008 2007

Number

of

Shares

Weighted-

Average

Exercise

Price

Number

of

Shares

Weighted-

Average

Exercise

Price

Number

of

Shares

Weighted-

Average

Exercise

Price

(in thousands, except prices per share)

Options outstanding at

beginning of year ....... 6,080 $18.64 5,977 $19.57 6,048 $19.15

Granted ............... 1,521 $10.02 588 $11.73 778 $22.38

Exercised .............. (181) $ 8.76 (81) $ 9.76 (474) $15.29

Expired or cancelled ....... (418) $21.03 (404) $24.12 (375) $23.99

Options outstanding at end of

year................. 7,002 $16.88 6,080 $18.64 5,977 $19.57

Options exercisable at end of

year ................ 5,084 $18.85 4,812 $18.89 4,530 $18.27

Options available for future

grant at end of year ...... 2,214 4,890 5,804

The total intrinsic value of options exercised (the difference between the market price of the Company’s

common stock on the exercise date and the price paid by the optionee to exercise the option) for 2009, 2008 and

2007 was $0.4 million, $0.2 million and $2.7 million, respectively. The aggregate intrinsic value for stock options

outstanding and for stock options exercisable (the difference between the Company’s closing stock price on the

last trading day of the period and the exercise price of the options, multiplied by the number of in-the-money

stock options) as of January 30, 2010 was $2.4 million and $0.7 million, respectively. The Company received

$1.6 million in cash from option exercises for the year ended January 30, 2010. The tax benefit realized by the

Company on stock option exercises for the year ended January 30, 2010 was not significant. Compensation

expense related to the Company’s stock options and employee stock purchase plan was $3.8 million, $3.5 million

and $4.5 million for 2009, 2008, and 2007, respectively.

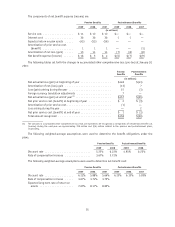

The following table summarizes information about stock options outstanding and exercisable at January 30,

2010: Options Outstanding Options Exercisable

Range of Exercise Prices Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price Number

Exercisable

Weighted-

Average

Exercise

Price

(in thousands, except prices per share)

$9.51 to $10.10 ................... 1,486 9.25 $10.00 145 $ 9.95

$10.22 to $11.91 .................. 1,682 4.08 $11.29 1,340 $11.25

$12.30 to $23.42 .................. 1,868 4.16 $18.09 1,634 $17.61

$23.59 to $27.01 .................. 1,483 5.02 $24.95 1,482 $24.95

$27.10 to $28.50 .................. 483 4.87 $28.08 483 $28.08

$9.51 to $28.50 ................... 7,002 5.45 $16.88 5,084 $18.85

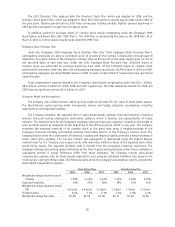

Changes in the Company’s nonvested options at January 30, 2010 are summarized as follows:

Number of

Shares

Weighted-

Average Grant

Date Fair Value

per Share

(in thousands)

Nonvested at February 1, 2009 ............................ 1,268 $17.71

Granted ........................................... 1,521 10.02

Vested ........................................... (453) 14.36

Expired or Cancelled .................................. (418) 21.03

Nonvested at January 30, 2010 ........................... 1,918 11.67

60