Foot Locker 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

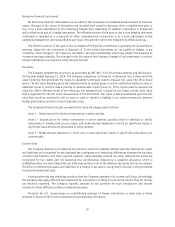

Sales

2009 2008 2007

(in millions)

Athletic Stores ......................................... $4,448 $4,847 $5,071

Direct-to-Customers ..................................... 406 390 364

Family Footwear ........................................ — — 2

Total sales .......................................... $4,854 $5,237 $5,437

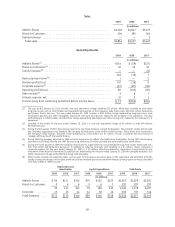

Operating Results

2009 2008 2007

(in millions)

Athletic Stores

(1)

....................................... $114 $ (59) $(27)

Direct-to-Customers

(2)

.................................... 32 43 40

Family Footwear

(3)

...................................... — — (6)

146 (16) 7

Restructuring income

(4)

................................... 1 — 2

Division profit (loss) ..................................... 147 (16) 9

Corporate expense

(5)

..................................... (67) (87) (59)

Operating profit (loss) .................................... 80 (103) (50)

Other income

(6)

........................................ 3 8 1

Interest expense, net .................................... 10 5 1

Income (loss) from continuing operations before income taxes ......... $ 73 $(100) $(50)

(1) The year ended January 30, 2010 includes non-cash impairment charges totaling $32 million, which were recorded to write-down

long-lived assets such as store fixtures and leasehold improvements at the Company’s Lady Foot Locker, Kids Foot Locker, Footaction,

and Champs Sports divisions. The year ended January 31, 2009 includes a $241 million charge representing long-lived store asset

impairment, goodwill and other intangibles impairment and store closing costs related to the Company’s U.S. operations. The year

ended February 2, 2008 includes a $128 million charge representing impairment and store closing costs related to the Company’s U.S.

operations.

(2) Included in the results for the year ended January 30, 2010 is a non-cash impairment charge of $4 million to write off software

development costs.

(3) During the first quarter of 2007, the Company launched a new family footwear concept, Footquarters. The concept’s results did not meet

the Company’s expectations and, therefore, the Company decided not to invest further in this business. These stores were converted to

the Company’s other formats. Included in the operating loss of $6 million was $2 million of costs associated with the removal of

signage and the write-off of unusable fixtures.

(4) During 2009, the Company adjusted its 1999 restructuring reserves to reflect a favorable lease termination. During 2007, the Company

adjusted its 1993 Repositioning and 1991 Restructuring reserve by $2 million primarily due to favorable lease terminations.

(5) During the fourth quarter of 2009, the Company restructured its organization by consolidating the Lady Foot Locker, Foot Locker U.S.,

Kids Foot Locker and Footaction businesses in addition to reducing corporate staff resulting in a $5 million charge. Included in

corporate expense for the year ended January 31, 2009 is a $3 million other-than-temporary impairment charge related to the

investment in the Reserve International Liquidity Fund. Additionally, for the year ended January 31, 2009 the Company recorded a $15

million impairment charge on the Northern Group note receivable.

(6) Other income includes non-operating items, such as gains from insurance recoveries, gains on the repurchase and retirement of bonds,

royalty income, the changes in fair value, premiums paid and realized gains associated with foreign currency option contracts, described

more fully in Note 4, ‘‘Other Income.’’

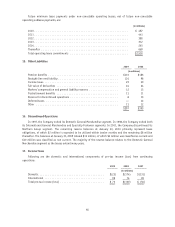

Depreciation and

Amortization Capital Expenditures Total Assets

2009 2008 2007 2009 2008 2007 2009 2008 2007

(in millions)

Athletic Stores .... $ 90 $111 $146 $70 $122 $125 $1,873 $1,879 $2,300

Direct-to-Customers . 9 6 6 5 6 7 291 297 197

99 117 152 75 128 132 2,164 2,176 2,497

Corporate ........ 13 13 14 14 18 16 652 701 746

Total Company .... $112 $130 $166 $89 $146 $148 $2,816 $2,877 $3,243

39