Foot Locker 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Depreciation and Amortization

Depreciation and amortization of $112 million decreased by 13.8 percent in 2009 from $130 million in 2008.

This decrease primarily reflects the effect of the impairment charges offset, in part, by increased depreciation and

amortization related to the Company’s capital spending, as well as the amortization expense associated with the

CCS customer list intangible. The effect of foreign currency fluctuations was not significant.

Depreciation and amortization of $130 million decreased by 21.7 percent in 2008 from $166 million in 2007.

This decrease primarily reflects the effect of the 2007 impairment charges offset, in part, by increased

depreciation and amortization related to the Company’s capital spending. The effect of foreign currency

fluctuations was not significant.

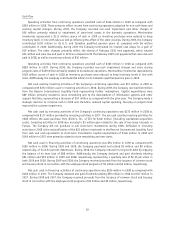

Interest Expense, Net

2009 2008 2007

(in millions)

Interest expense................................ $13 $16 $21

Interest income ................................ (3) (11) (20)

Interest expense, net ........................... $10 $ 5 $ 1

Weighted-average interest rate (excluding facility fees):

Long-term debt ............................... 7.3% 6.2% 8.0%

Interest expense of $13 million decreased by $3 million as compared with 2008. The decrease in interest

expense primarily relates to the termination of the cross currency swaps, which represented expense of $3 million

in 2008, as well as lower average debt outstanding during 2009. Interest expense in 2009 was also reduced by

$1 million, reflecting the effect of the amortization of the gain realized from the termination of the interest rate

swap. This was offset, in part, by higher fees associated with the revolving credit facility. The Company did not

have any short-term borrowings for any of the periods presented. Interest income of $3 million declined from

$11 million in 2008 primarily due to lower interest rates received on its cash, cash equivalents and short-term

investments.

Interest expense of $16 million decreased by $5 million in 2008 compared with $21 million in 2007. The

reduction in interest expense primarily relates to the repayment of the term loan in May 2008 and the purchases

and retirements of $6 million and $5 million in 2008 and 2007, respectively, of the Company’s 8.50 percent

debentures. Interest rate swap agreements reduced interest expense in 2008 by $2 million, while the cross

currency swaps increased interest expense by $3 million. Interest income of $11 million declined from

$20 million in 2007. Interest income is mainly generated through the investment of cash equivalents and

short-term investments. The decline in interest income reflects the lower interest rates received on cash, cash

equivalents and short-term investments, which totaled $10 million in 2008 and $16 million in 2007. Additionally,

the Company did not record accretion income related to the Northern Group note, which in the prior year totaled

$2 million.

Other Income

Other income of $3 million in 2009 includes $4 million related to gains from insurance recoveries, gains on

the purchase and retirement of bonds, and royalty income, partially offset by $1 million of foreign currency

option contract premiums. The Company uses these derivatives to mitigate the effect of fluctuating foreign

exchange rates on the reporting of foreign currency denominated earnings.

Other income of $8 million in 2008 includes a net gain of $4 million, which is comprised of the changes in

fair value, realized gains and premiums paid on foreign currency contracts. Additionally, 2008 includes a

$3 million gain on lease terminations related to two lease interests in Europe.

Income Taxes

The effective tax rate for 2009 was an expense of 36.0 percent, as compared with a benefit of 20.8 percent in

2008. The effective tax rate changed primarily due to impairment charges in 2008, which created an overall book

loss, coupled with the effect of an impairment of goodwill, a portion of which was not deductible for tax purposes,

as well as 2009 Canadian provincial tax rate changes that resulted in a $4 million reduction in the value of the

Company’s net deferred tax assets.

15