Foot Locker 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

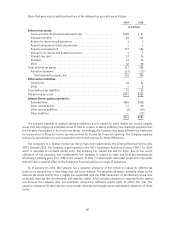

Lease acquisition costs represent amounts that are required to secure prime lease locations and other lease

rights, primarily in Europe. Included in finite life intangibles are the customer relationship intangible associated

with the purchase of CCS, trademark for the Footaction name, favorable leases associated with acquisitions and

amounts paid to obtain names of members of the Footaction loyalty program. The CCS customer relationship

intangible is amortized on a straight-line basis over 5 years, which represents the pattern in which the economic

benefits are expected to be realized.

Amortization expense for the intangibles subject to amortization was $19 million, $18 million, and

$19 million for 2009, 2008, and 2007, respectively. Annual estimated amortization expense for finite life

intangible assets is expected to approximate $18 million for 2010, $16 million for 2011, $14 million for 2012,

$9 million for 2013 and $3 million for 2014.

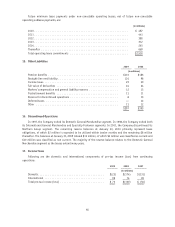

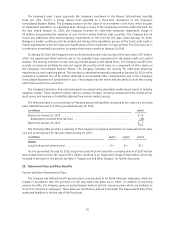

10. Other Assets

2009 2008

(in millions)

Prepaid income taxes ...................................... $ 6 $ 6

Auction rate security ...................................... 5 2

Deferred tax costs ........................................ 5 7

Income tax asset ......................................... 2 2

Fair value of derivative contracts .............................. — 19

Other ................................................ 33 30

$51 $66

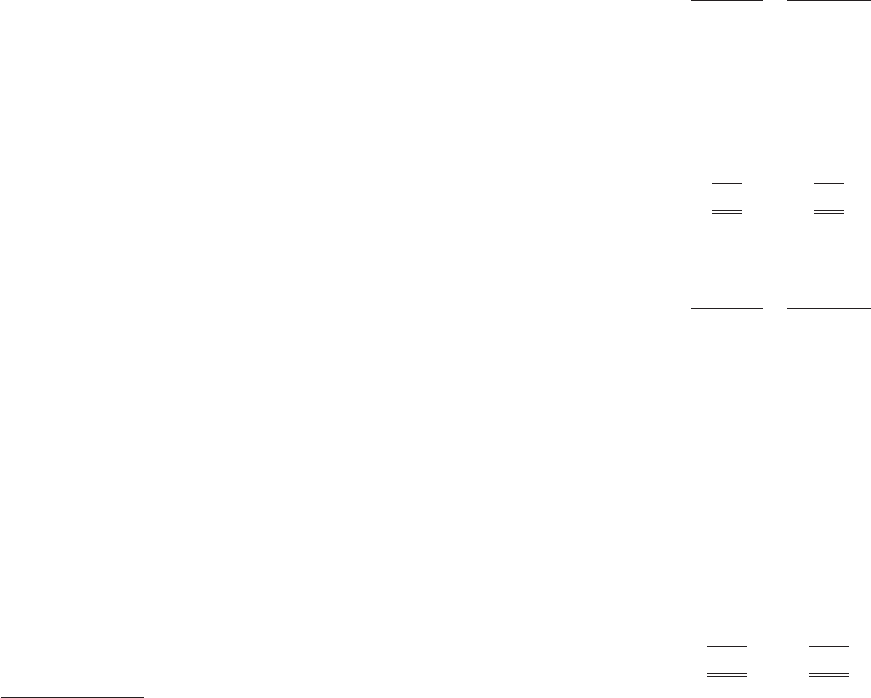

11. Accrued and Other Liabilities

2009 2008

(in millions)

Other payroll and payroll related costs, excluding taxes ............... $ 46 $ 50

Taxes other than income taxes ................................ 41 36

Customer deposits

(1)

...................................... 29 32

Property and equipment .................................... 13 13

Income taxes ........................................... 10 —

Incentive bonuses ........................................ 9 23

Income taxes payable ..................................... 7 4

Current deferred tax liabilities ................................ 5 10

Pension and postretirement benefits ............................ 5 4

Sales return reserve ....................................... 3 4

Reserve for discontinued operations ............................ 2 2

Other operating costs ...................................... 48 53

$218 $231

(1) Customer deposits include unredeemed gift cards and certificates, merchandise credits, and deferred revenue related to undelivered

merchandise, including layaway sales.

44