Foot Locker 2009 Annual Report Download - page 56

Download and view the complete annual report

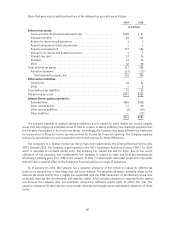

Please find page 56 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On February 4, 2007, the Company adopted authoritative guidance for the Accounting for Uncertainty in

Income Taxes, as prescribed by ASC 740, ‘‘Income Taxes.’’ The guidance clarifies the accounting for uncertainty in

income taxes recognized in an enterprise’s financial statements and prescribes a recognition threshold and

measurement standard for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. Upon the adoption of the guidance, the Company recognized a $1 million

increase to retained earnings to reflect the change of its liability for its unrecognized income tax benefits. The

Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense.

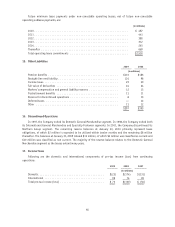

Pension and Postretirement Obligations

The discount rate selected to measure the present value of the Company’s U.S. benefit obligations at

January 30, 2010 was derived using a cash flow matching method whereby the Company matches the plans’

projected payment obligations by year with the corresponding yield on the Citibank Pension Discount Curve. The

cash flows are then discounted to their present value and an overall discount rate is determined. The discount

rate selected to measure the present value of the Company’s Canadian benefit obligations at January 30, 2010

was developed by using the plan’s bond portfolio indices, which match the benefit obligations.

Insurance Liabilities

The Company is primarily self-insured for health care, workers’ compensation and general liability costs.

Accordingly, provisions are made for the Company’s actuarially determined estimates of discounted future claim

costs for such risks, for the aggregate of claims reported and claims incurred but not yet reported. Self-insured

liabilities totaled $15 million and $16 million at January 30, 2010 and January 31, 2009, respectively. The

Company discounts its workers’ compensation and general liability using a risk-free interest rate. Imputed

interest expense related to these liabilities was not significant for 2009 and 2008 and was $1 million in 2007.

Accounting for Leases

The Company recognizes rent expense for operating leases as of the possession date for store leases or the

commencement of the agreement for a non-store lease. Rental expense, inclusive of rent holidays, concessions

and tenant allowances are recognized over the lease term on a straight-line basis. Contingent payments based

upon sales and future increases determined by inflation-related indices cannot be estimated at the inception of

the lease and accordingly, are charged to operations as incurred.

Foreign Currency Translation

The functional currency of the Company’s international operations is the applicable local currency. The

translation of the applicable foreign currency into U.S. dollars is performed for balance sheet accounts using

current exchange rates in effect at the balance sheet date and for revenue and expense accounts using the

weighted-average rates of exchange prevailing during the year. The unearned gains and losses resulting from

such translation are included as a separate component of accumulated other comprehensive loss within

shareholders’ equity.

Recent Accounting Pronouncements Not Previously Discussed Herein

Recently issued accounting pronouncements did not, or are not believed by management to, have a material

effect on the Company’s present or future consolidated financial statements.

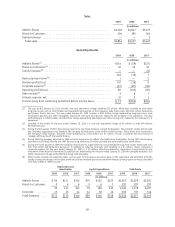

2. Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of January 30, 2010, the Company has two reportable segments, Athletic Stores and

Direct-to-Customers. The Company acquired CCS during the fourth quarter of 2008, and its operations are

presented within the Direct-to-Customers segment. The Company also operated the Family Footwear segment,

which included the retail format under the Footquarters brand name through the second quarter of 2007. During

the third quarter, the Company converted the Footquarters stores, which were the only stores reported under the

Family Footwear segment, to Foot Locker and Champs Sports outlet stores. The Company has concluded that the

Footquarters store closings are not discontinued operations.

The accounting policies of both segments are the same as those described in the ‘‘Summary of Significant

Accounting Policies’’ note. The Company evaluates performance based on several factors, of which the primary

financial measure is division results. Division profit (loss) reflects income (loss) from continuing operations

before income taxes, corporate expense, non-operating income, and net interest expense.

38