Foot Locker 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Another wholly owned subsidiary of the Company was the assignor of the store leases involved in the

Northern Group transaction and, therefore, retains potential liability for such leases. As the assignor of the

Northern Canada leases, the Company remained secondarily liable under these leases. At January 30, 2010, the

Company estimates that its gross contingent lease liability is CAD$1 million. The Company currently estimates

the expected value of the lease liability to be insignificant. The Company believes that, because it is secondarily

liable on the leases, it is unlikely that it would be required to make such contingent payments.

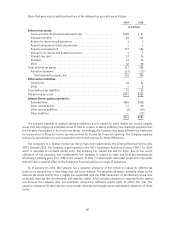

4. Other Income

Other income was $3 million, $8 million and $1 million for 2009, 2008 and 2007, respectively. For the year

ended January 30, 2010, other income includes $4 million related to gains from insurance recoveries, gains on the

purchase and retirement of bonds, and royalty income partially offset by $1 million of foreign currency option

contract premiums. Other income in 2008 primarily reflects a $4 million net gain related to the Company’s foreign

currency options contracts and a $3 million gain on lease terminations related to two lease interests in Europe.

For 2007, other income includes a $1 million gain related to a final settlement with the Company’s insurance

carriers of a claim related to a store damaged by fire in 2006. Additionally, the Company sold two of its lease

interests in Europe for a gain of $1 million. These gains were offset primarily by premiums paid for foreign

currency option contracts.

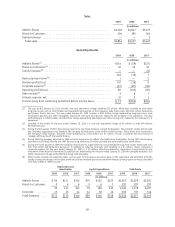

5. Merchandise Inventories

2009 2008

(in millions)

LIFO inventories ......................................... $ 682 $ 788

FIFO inventories ......................................... 355 332

Total merchandise inventories ................................ $1,037 $1,120

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as

calculated on a FIFO basis.

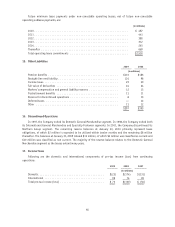

6. Other Current Assets

2009 2008

(in millions)

Net receivables .......................................... $ 37 $ 53

Prepaid expenses and other current assets ........................ 33 33

Prepaid rent ............................................ 28 62

Prepaid income taxes ...................................... 25 47

Income tax receivable ..................................... 5 7

Fair value of derivative contracts .............................. 1 5

Deferred taxes .......................................... 17 29

$146 $236

42