Foot Locker 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

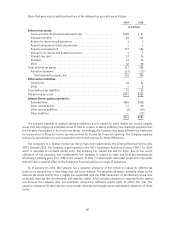

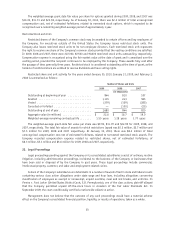

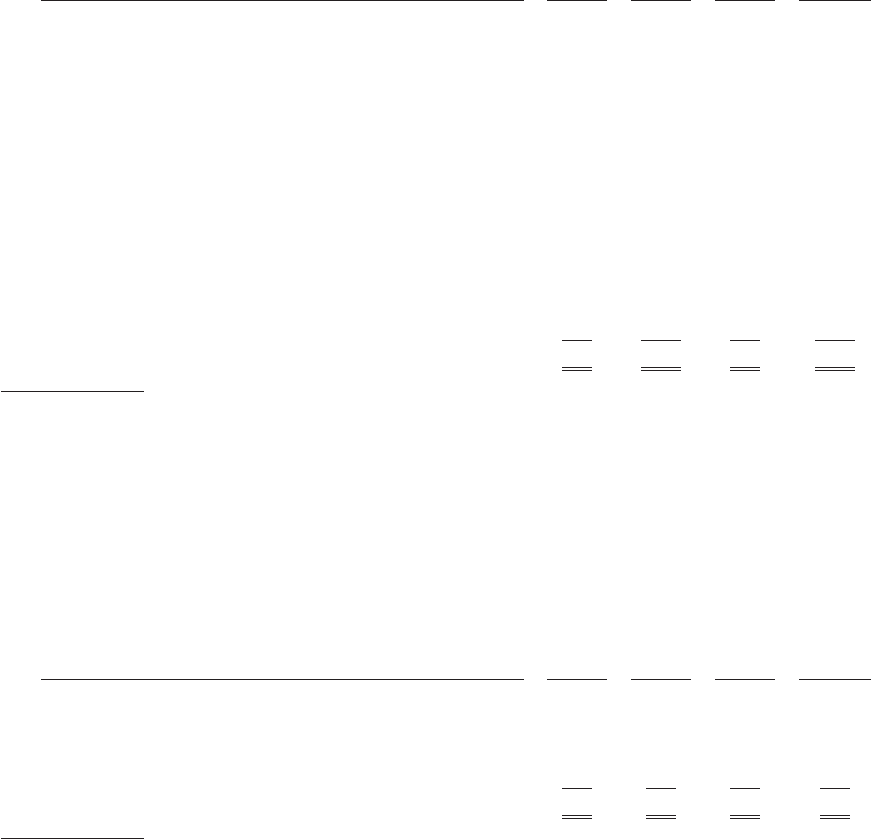

The fair values of the Company’s U.S. pension plan assets at January 30, 2010 are as follows:

(in millions) Level 1 Level 2 Level 3 Total

Cash and cash equivalents ....................... $— $ 5 $— $ 5

Equity securities:

U.S. large-cap

(a)

........................... — 110 — 110

U.S. mid-cap

(a)

............................ — 36 — 36

International

(b)

............................ — 62 — 62

Corporate stock

(c)

.......................... 17 — — 17

Fixed income securities:

Long duration corporate and government bonds

(d)

..... — 200 — 200

Intermediate duration corporate and government

bonds

(e)

............................... — 27 — 27

Other types of investments:

Real estate ............................... — — 7 7

Insurance contracts ......................... — 1 — 1

Total assets at fair value ........................ $17 $441 $ 7 $465

(a) These categories consist of various managed funds that invest primarily in common stocks, as well as other equity securities and a

combination of other funds.

(b) This category comprises two managed funds that invest primarily in international common stocks, as well as other equity securities and

a combination of other funds.

(c) This category consists of common and preferred stock issued by U.S. and non-U.S. corporations, including $4 million invested in the

Company’s common stock.

(d) This category consists of various fixed income funds that invest primarily in long-term bonds, as well as a combination of other funds,

that together are designed to exceed the performance of related long-term market indices.

(e) This category consists of a fixed income fund that invests primarily in intermediate duration bonds, as well as a combination of other

funds, that together are designed to track the performance of the Barclays Capital U.S. Intermediate Credit Index.

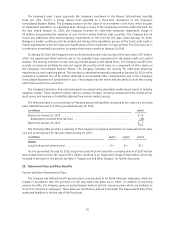

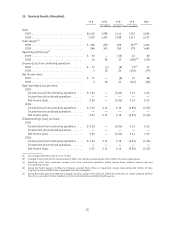

The fair values of the Company’s Canadian pension plan assets at January 30, 2010 are as follows:

(in millions) Level 1 Level 2 Level 3 Total

Equity securities:

Canadian equity securities

(a)

................... $— $ 7 $— $ 7

Debt securities:

Cash matched bonds

(b)

....................... — 78 — 78

Total assets at fair value ........................ $— $85 $— $85

(a) This category comprises a mutual fund that invests in a diverse portfolio of Canadian equity securities, and convertible bonds.

(b) This category consists of fixed income securities, including strips and coupons, issued or guaranteed by the Government of Canada,

provinces or municipalities of Canada including their agencies and crown corporations, as well as corporate bonds.

No Level 3 assets were held by the Canadian pension plan during 2009, and there was no activity within the

U.S. pension plan’s real estate investments classified as Level 3 for the year ended January 30, 2010.

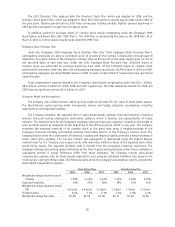

During 2009 the Company made contributions of $97 million and $3 million to its U.S. and Canadian plans,

respectively. In accordance with the Pension Protection Act, the Company contributed to its U.S. pension plan

amounts in excess of the minimum requirements. The Company contributed approximately $2 million to its

Canadian pension plan in February 2010. The Company continuously evaluates the amount and timing of any

future contributions. Additional contributions will depend on the plan asset performance for the balance of the

year and statutory or regulatory changes that may occur, if any.

57