Foot Locker 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

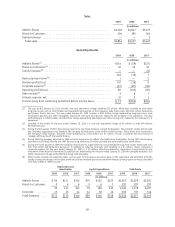

Advertising Costs and Sales Promotion

Advertising and sales promotion costs are expensed at the time the advertising or promotion takes place,

net of reimbursements for cooperative advertising. Advertising expenses also include advertising costs as

required by some of the Company’s mall-based leases. Cooperative advertising reimbursements earned for the

launch and promotion of certain products agreed upon with vendors is recorded in the same period as the

associated expenses are incurred. The Company accounts for reimbursements received in excess of expenses

incurred related to specific, incremental, identifiable advertising, as a reduction to the cost of merchandise,

which is reflected in cost of sales as the merchandise is sold.

Advertising costs, which are included as a component of selling, general and administrative expenses were

as follows:

2009 2008 2007

(in millions)

Advertising expenses .............................. $94.0 $106.8 $105.9

Cooperative advertising reimbursements ................. (25.2) (40.2) (34.8)

Net advertising expense ............................ $68.8 $ 66.6 $ 71.1

Catalog Costs

Catalog costs, which primarily comprise paper, printing, and postage, are capitalized and amortized over the

expected customer response period related to each catalog, which is generally 90 days. Cooperative

reimbursements earned for the promotion of certain products are agreed upon with vendors and are recorded in

the same period as the associated catalog expenses are amortized. Prepaid catalog costs totaled $3.9 million and

$3.1 million at January 30, 2010 and January 31, 2009, respectively.

Catalog costs, which are included as a component of selling, general and administrative expenses, were as

follows:

2009 2008 2007

(in millions)

Catalog costs ................................... $48.4 $48.0 $45.6

Cooperative reimbursements ......................... (4.3) (4.1) (3.8)

Net catalog expense .............................. $44.1 $43.9 $41.8

Earnings Per Share

The Company accounts for and discloses net earnings (loss) per share using the treasury stock method. The

Company’s basic earnings per share is computed by dividing the Company’s reported net income (loss) for the

period by the weighted-average number of common shares outstanding at the end of the period. The Company’s

restricted stock awards, which contain non-forfeitable rights to dividends, are considered participating securities

and are included in the calculation of basic earnings per share. Diluted earnings per share reflects the

weighted-average number of common shares outstanding during the period used in the basic earnings per share

computation plus dilutive common stock equivalents.

34