Foot Locker 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

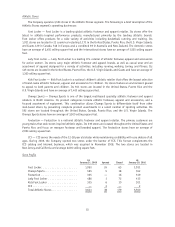

The following table provides a reconciliation of reported GAAP results to income from continuing operations

excluding impairment charges, the inventory reserve, Canadian tax rate changes, reorganization costs, store

closing program costs, and the income tax valuation adjustment in 2007, which is considered a non-GAAP

financial measure. The Company believes this information is a useful measure to investors because it allows for a

more direct comparison of the Company’s performance for the year with the Company’s performance in prior

periods.

2009 2008 2007

(in millions)

Income (loss) from continuing operations − GAAP ......... $ 47 $ (79) $ 43

Impairment charges, after-tax:

Store long-lived assets .......................... 22 41 78

Goodwill and other intangibles..................... — 123 —

Northern Group note ........................... — 15 —

Money-market fund ............................ — 3 —

Total impairment charges .......................... 22 182 78

Inventory reserve, after tax

(1)

....................... 9 — —

Canadian tax rate changes ......................... 4 — —

Reorganization costs, after tax ...................... 3 — —

Store closing program costs, after-tax .................. — 3 3

Canadian valuation allowance adjustment ............... — — (62)

Income from continuing operations − Non-GAAP .......... $ 85 $ 106 $ 62

Diluted earnings per share:

Income (loss) from continuing operations − GAAP ......... $0.30 $(0.52) $ 0.28

Total impairment charges .......................... 0.14 1.18 0.50

Inventory reserve ............................... 0.06 — —

Canadian tax rate changes ......................... 0.02 — —

Reorganization costs ............................. 0.02 — —

Store closing program costs ........................ — 0.02 0.02

Canadian valuation allowance adjustment ............... — — (0.40)

Income from continuing operations − Non-GAAP .......... $0.54 $ 0.68 $ 0.40

(1) The $14 million inventory reserve pre-tax charge is included in cost of sales.

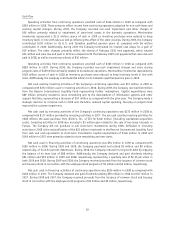

Other highlights of the year:

• Cash, cash equivalents and short-term investments at January 30, 2010 were $589 million.

• Cash flow provided by operations was $346 million, which includes qualified pension contributions

totaling $100 million, thereby improving the funded status of the qualified plans to 87 percent in 2009

as compared with 72 percent in 2008.

• Merchandise inventories at January 30, 2010 were $1,037 million, which represents a reduction of

$83 million from the corresponding prior-year period. Excluding the effect of foreign currency

fluctuations, inventories declined by approximately 10 percent.

• Dividends totaling $94 million were declared and paid.

• The Company closed 179 underproductive stores, most of which were at lease expiration.

12