Foot Locker 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

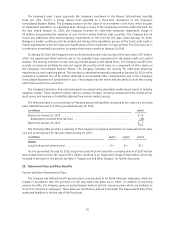

Derivative Holdings Designated as Non-Hedges

The Company mitigates the effect of fluctuating foreign exchange rates on the reporting of foreign currency

denominated earnings by entering into a variety of derivative instruments, including option currency contracts.

Changes in the fair value of these foreign currency option contracts, which are designated as non-hedges, are

recorded in earnings immediately within other income. The realized gains, premiums paid and changes in the fair

market value recorded in the Consolidated Statements of Operations was not significant and was $4 million of

income for the years ended January 30, 2010 and January 31, 2009, respectively, and was not significant for the

year ended February 2, 2008. The notional value of the option currency contract outstanding at January 30, 2010

was $8 million.

The Company also enters into forward foreign exchange contracts to hedge foreign-currency denominated

merchandise purchases and intercompany transactions. Net changes in the fair value of foreign exchange

derivative financial instruments designated as non-hedges were substantially offset by the changes in value of

the underlying transactions, which were recorded in selling, general and administrative expenses. The amount

recorded for all the periods presented was not significant.

The Company enters into monthly diesel fuel forward and option contracts to mitigate a portion of the

Company’s freight expense due to the variability caused by fuel surcharges imposed by our third-party freight

carriers. The notional value of the contracts outstanding at January 30, 2010 was $4 million and these contracts

extend through November 2010. Changes in the fair value of these contracts are recorded in earnings

immediately. The effect was not significant for any of the periods presented.

As discussed above, the Company terminated its European net investment hedge during the third quarter of

2008. During the remaining term of the agreement, the Company will remit to its counterparty interest payments

based on one-month U.S. LIBOR rates on the $24 million liability. The agreement includes a provision that may

require the Company to settle this transaction in August 2010, at the option of the Company or the counterparty.

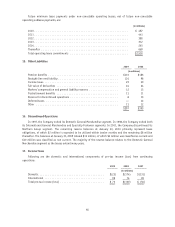

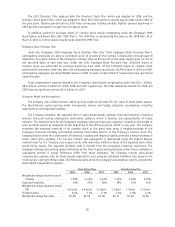

Fair Value of Derivative Contracts

The following represents the fair value of the Company’s derivative contracts. Many of the Company’s

agreements allow for a netting arrangement. The following is presented on a gross basis, by type of contract:

2009 2008

(in millions) Balance Sheet Caption Fair Value Balance Sheet Caption Fair Value

Hedging Instruments:

Forward foreign exchange contracts . . . Current assets $ — Current assets $ 3

Interest rate swaps .............. Noncurrent assets — Non current assets 19

Total ........................ $— $22

Non Hedging Instruments:

Forward foreign exchange contracts . . . Current assets $ 1 Current assets $ 2

European cross currency swap ....... Noncurrent liability (24) Non current liability (24)

Fuel forwards and options contracts . . . Non current liability — Non current liability (1)

Total ........................ $(23) $(23)

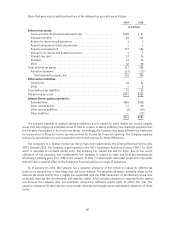

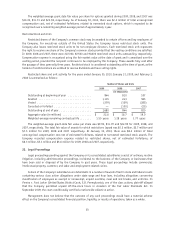

Foreign Currency Exchange Rates

The table below presents the notional amounts and weighted-average exchange rates of foreign exchange

forward contracts outstanding at January 30, 2010. Contract Value

(U.S. in millions) Weighted-Average

Exchange Rate

Inventory

Buy €/Sell British £ ..................................... $30 .8664

Buy US/Sell €......................................... 9 .6864

Intercompany

Buy €/Sell British £ ...................................... $21 .8674

Buy US/Sell CAD$........................................ 7 1.0376

51