Foot Locker 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s Level 3 asset represents the Company’s investment in the Reserve International Liquidity

Fund, Ltd. (the ‘‘Fund’’), a money market fund classified as a short-term investment on the Company’s

Consolidated Balance Sheets. The Company assesses the fair value of its investment in the Fund, which includes

an impairment evaluation, on a quarterly basis, through a review of the underlying securities within the Fund. For

the year ended January 31, 2009, the Company recorded an other-than-temporary impairment charge of

$3 million, incorporating the valuation at zero for the Lehman Brothers debt securities. The Company did not

record any additional other-than-temporary impairments on the fund for the year ended January 30, 2010.

Changes in market conditions and the method and timing of the liquidation process of the Fund could result in

further adjustments to the fair value and classification of this investment in future periods. The Fund was not in

a continuous unrealized loss position for greater than twelve months at January 30, 2010.

At January 30, 2010, the Company held a preferred stock auction rate security with a face value of $7 million,

which has experienced failed auctions due to the liquidity issues experienced in the global credit and capital

markets. The security continues to earn and pay interest based on the stated terms. The Company classifies the

security as long-term available-for-sale and reports the security at fair value as a component of other assets on

the Company’s Consolidated Balance Sheets. The Company evaluates the security for other-than-temporary

impairments at each reporting period. The security is considered temporarily impaired at January 30, 2010 with a

cumulative unrealized loss of $2 million reflected in accumulated other comprehensive loss in the Company’s

Consolidated Statement of Comprehensive Loss. The Company has the intent and the ability to hold the security

until future auctions are successful.

The Company’s derivative financial instruments are valued using observable market-based inputs to industry

valuation models. These valuation models require a variety of inputs, including contractual terms, market prices,

yield curves, and measures of volatility obtained from various market sources.

The following table is a reconciliation of financial assets and liabilities measured at fair value on a recurring

basis classified as Level 3, for the year ended January 30, 2010:

(in millions) Level 3

Balance at January 31, 2009 ......................................... $23

Redemptions received from the Fund .................................. (16)

Balance at January 30, 2010 ......................................... $ 7

The following table provides a summary of the Company’s recognized assets that are measured at fair value

on a non-recurring basis for the year ended January 30, 2010:

(in millions) Level 1 Level 2 Level 3

Assets

Long-lived assets held and used ....................... $— $— $71

For the year ended January 30, 2010, long-lived assets held and used with a carrying amount of $107 million

were written down to their fair value of $71 million, resulting in an impairment charge of $36 million, which was

included in earnings for the period. See Note 3, ‘‘Impairment and Other Charges,’’ for further discussion.

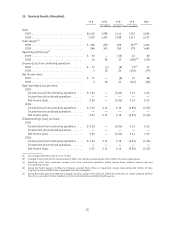

20. Retirement Plans and Other Benefits

Pension and Other Postretirement Plans

The Company has defined benefit pension plans covering most of its North American employees, which are

funded in accordance with the provisions of the laws where the plans are in effect. In addition to providing

pension benefits, the Company sponsors postretirement medical and life insurance plans, which are available to

most of its retired U.S. employees. These plans are contributory and are not funded. The measurement date of the

assets and liabilities is the last day of the fiscal year.

53