Foot Locker 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

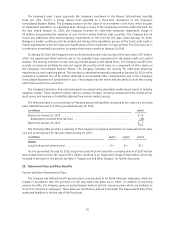

Future minimum lease payments under non-cancelable operating leases, net of future non-cancelable

operating sublease payments, are:

(in millions)

2010....................................................... $ 487

2011....................................................... 441

2012....................................................... 380

2013....................................................... 312

2014....................................................... 261

Thereafter ................................................... 669

Total operating lease commitments .................................. $2,550

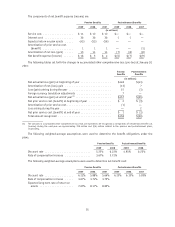

15. Other Liabilities

2009 2008

(in millions)

Pension benefits ......................................... $101 $183

Straight-line rent liability ................................... 101 98

Income taxes ........................................... 29 30

Fair value of derivatives .................................... 24 24

Workers’ compensation and general liability reserves ................. 12 13

Postretirement benefits .................................... 11 11

Reserve for discontinued operations ............................ 8 10

Deferred taxes .......................................... — 12

Other ................................................ 11 12

$297 $393

16. Discontinued Operations

In 1997, the Company exited its Domestic General Merchandise segment. In 1998, the Company exited both

its International General Merchandise and Specialty Footwear segments. In 2001, the Company discontinued its

Northern Group segment. The remaining reserve balances at January 30, 2010 primarily represent lease

obligations, of which $2 million is expected to be utilized within twelve months and the remaining $8 million

thereafter. The balances at January 31, 2009 totaled $12 million, of which $2 million was classified as current and

$10 million was classified as non current. The majority of the reserve balance relates to the Domestic General

Merchandise segment as the leases extend many years.

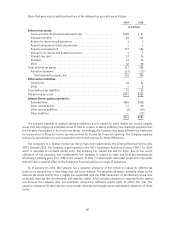

17. Income Taxes

Following are the domestic and international components of pre-tax income (loss) from continuing

operations:

2009 2008 2007

(in millions)

Domestic ...................................... $(23) $(174) $(131)

International ................................... 96 74 81

Total pre-tax income (loss) .......................... $73 $(100) $ (50)

46