Foot Locker 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Derivative Financial Instruments

All derivative financial instruments are recorded in the Company’s Consolidated Balance Sheets at their fair

values. Changes in fair values of derivatives are recorded each period in earnings, other comprehensive gain or

loss, or as a basis adjustment to the underlying hedged item, depending on whether a derivative is designated

and is effective as part of a hedge transaction. The effective portion of the gain or loss on the hedging derivative

instrument is reported as a component of other comprehensive income/loss or as a basis adjustment to the

underlying hedged item and reclassified to earnings in the period in which the hedged item affects earnings.

The effective portion of the gain or loss on hedges of foreign net investments is generally not reclassified to

earnings unless the net investment is disposed of. To the extent derivatives do not qualify as hedges, or are

ineffective, their changes in fair value are recorded in earnings immediately, which may subject the Company to

increased earnings volatility. The changes in the fair value of the Company’s hedges of net investments in various

foreign subsidiaries are computed using the spot method.

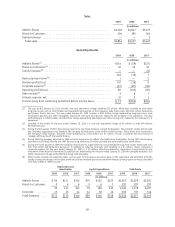

Fair Value

The Company adopted the provisions as prescribed by ASC 820, ‘‘Fair Value Measurements and Disclosures,’’

for the year ended January 31, 2009. The Company categorizes its financial instruments into a three-level fair

value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad

levels. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or

liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). If the inputs used to measure fair

value fall within different levels of the hierarchy, the category level is based on the lowest priority level input

that is significant to the fair value measurement of the instrument. Fair value is determined based upon the exit

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants exclusive of any transaction costs.

The Company’s financial assets recorded at fair value are categorized as follows:

Level 1 − Quoted prices for identical instruments in active markets.

Level 2 − Quoted prices for similar instruments in active markets; quoted prices for identical or similar

instruments in markets that are not active; and model-derived valuations in which all significant inputs or

significant value-drivers are observable in active markets.

Level 3 − Model-derived valuations in which one or more significant inputs or significant value-drivers are

unobservable.

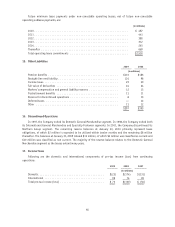

Income Taxes

The Company determines its deferred tax provision under the liability method, whereby deferred tax assets

and liabilities are recognized for the expected tax consequences of temporary differences between the tax basis

of assets and liabilities and their reported amounts using presently enacted tax rates. Deferred tax assets are

recognized for tax credits and net operating loss carryforwards, reduced by a valuation allowance, which is

established when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that

includes the enactment date.

A taxing authority may challenge positions that the Company adopted in its income tax filings. Accordingly,

the Company may apply different tax treatments for transactions in filing its income tax returns than for income

tax financial reporting. The Company regularly assesses its tax positions for such transactions and records

reserves for those differences when considered necessary.

Provision for U.S. income taxes on undistributed earnings of foreign subsidiaries is made only on those

amounts in excess of the funds considered to be permanently reinvested.

37