Experian 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Experian Annual Report 2012 Governance

Report on directors’ remuneration continued

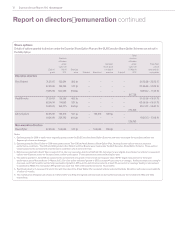

Performance Share Plan

Details of awards made to directors under the PSP are set out in the table below.

Date of

award

Experian

share

price on

date of

award

Plan

shares

held at

1 April

2011

Plan

shares

awarded

during the

year

Plan

shares

vested

during the

year

Plan

shares

lapsed

during the

year

Experian

share

price on

date of

vesting

Total

plan

shares at

31 March

2012

Normal

vesting

date

Don Robert 11.10.06 560.0p 199,084 –199,084 –740.0p

18.06.09 464.0p 552,453 – – – – 18.06.12

03.06.10 636.0p 317,316 – – – – 03.06.13

15.0 6.11 785.0p –233,006 – – – 15.06.14

1,072,775

Paul Brooks 11.10.06 560.0p 107,198 –107,198 –740.0p

18.06.09 464.0p 198,275 –187,259 11,016 864.5p

03.06.10 636.0p 151,515 –92,592 58,923 864.5p

15.0 6.11 785.0p –124,129 34,480 89,649 864.5p

–

Chris Callero 11.10.06 560.0p 114,855 –114,855 –740.0p

18.06.09 464.0p 236,765 – – – – 18.06.12

03.06.10 636.0p 203,519 –––– 03.06.13

15.0 6.11 785.0p –149,124 ––– 15.06.14

589,408

Notes:

1. Awards made in October 2006 were subject to performance conditions with a performance period which ended in October 2009. As detailed in the 2010 report,

the outcome of these performance conditions was such that 80.7% of these awards vested. The vesting date was 11 October 2011 when the Experian share

price was 740.0p. Dividend equivalents were paid to Paul Brooks, Chris Callero, and Don Robert on their vested shares. They received £67,535, US$122,321 and

US$212,024 respectively.

2. The awards granted in June 2009 are subject to performance conditions measured over the three years ending on 31 March 2012. 75% of an award will vest

subject to the achievement of a growth in PBT target: 25% of this part of an award will vest if growth in PBT is at least 4% per annum on average. Vesting

increases on a straight-line basis such that this part of the award will vest in full if growth in PBT is at least 8% per annum on average. 25% of an award will vest

subject to the achievement of a TSR target: 25% of this part of an award will vest if the TSR of Experian is at least equal to that of the FTSE 100 Index. Vesting

increases on a straight-line basis such that this part of the award will vest in full if Experian’s TSR exceeds that of the FTSE 100 Index by at least 25%. Vesting of

these awards is also subject to satisfactory ROCE performance. The Company’s performance was such that 100% of the awards will vest on 18 June 2012.

3. The performance periods in respect of the awards made in June 2010 and June 2011 are 1 April 2010 to 31 March 2013 and 1 April 2011 to 31 March 2014

respectively. The performance conditions attached to these awards are detailed in the section entitled ‘PSP performance metrics’ on page 73.

4. Paul Brooks died on 6 January 2012 and, in line with the rules of the Performance Share Plan, outstanding awards vested on that date and were pro-rated for

time.

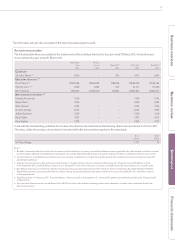

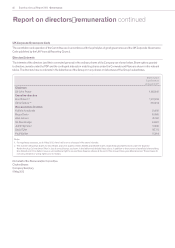

Executive directors’ pension arrangements

Don Robert is provided with benefits through a Supplementary Executive Retirement Plan (‘SERP’) which is a defined benefit arrangement in

the US. The figures below are in respect of his SERP entitlement. He is also entitled to participate in the US defined contribution arrangement

(401k Plan). The employer contributions to this arrangement during the year were nil (2011: nil).

Paul Brooks was a member of the registered Experian UK defined benefit pension scheme until his death on 6 January 2012. His benefits within

the scheme were restricted by an earnings cap with benefits in excess of this cap provided for through the Experian Limited Secured Unfunded

Retirement Benefit Scheme (SURBS). The closing figures in the table below in respect of Paul are given at date of death rather than as at

31 March 2012.

Chris Callero participated in the US defined contribution arrangement (401k Plan) during the year and the employer contributions to this

arrangement were US$7,104 (2011: $6,882).