Experian 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

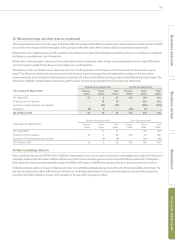

135

Governance Financial statementsBusiness reviewBusiness overview

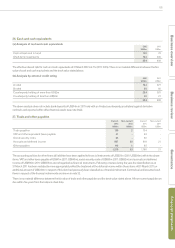

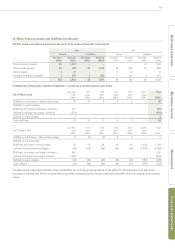

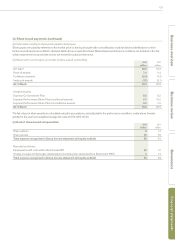

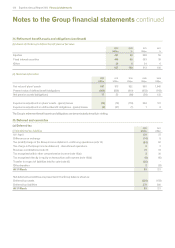

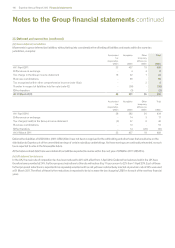

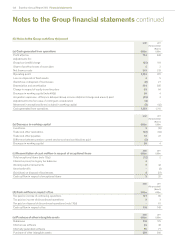

34. Retirement benefit assets and obligations (continued)

(ii) Movements in net retirement benefit assets recognised in the Group balance sheet

2012

US$m

2011

US$m

At 1 April 55 (88)

Differences on exchange -1

Income recognised in Group income statement 225

Actuarial gains recognised within other comprehensive income 9107

Contributions paid by the Group 11 10

At 31 March 77 55

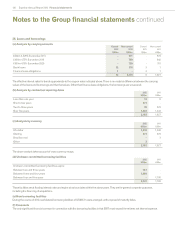

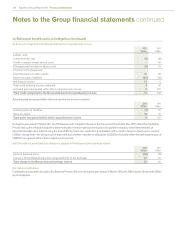

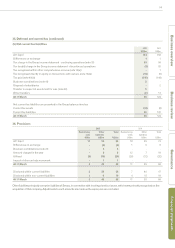

(iii) Present value of the total defined benefit obligations

Movements in the year

2012

US$m

2011

US$m

At 1 April 858 910

Differences on exchange (3) 48

Current service cost 910

Credit in respect of past service costs -(29)

Interest on plans’ liabilities 46 50

Actuarial losses/(gains) on liabilities 7(97)

Contributions paid by employees 44

Benefits paid (41) (38)

At 31 March 880 858

Analysis of the present value of the total defined benefit obligations

2012

US$m

2011

US$m

Funded arrangements 827 807

Unfunded arrangements 53 51

At 31 March 880 858

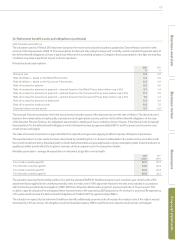

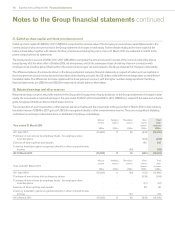

(iv) Movements in the fair value of the plans’ assets

2012

US$m

2011

US$m

At 1 April 913 822

Differences on exchange (3) 49

Expected return on plans’ assets 57 56

Actuarial gains on assets 16 10

Actual return on plans’ assets 73 66

Contributions paid by the Group 11 10

Contributions paid by employees 4 4

Benefits paid (41) (38)

At 31 March 957 913