Experian 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

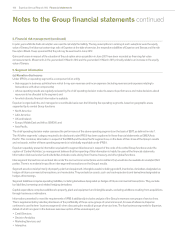

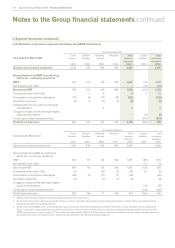

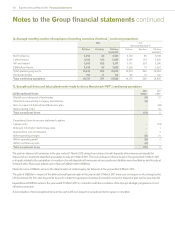

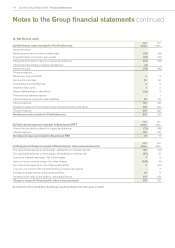

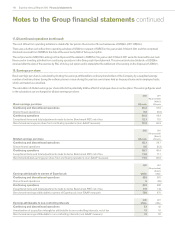

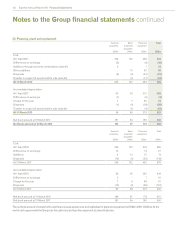

15. Tax (credit)/charge in the Group income statement (continued)

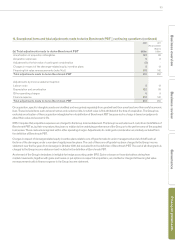

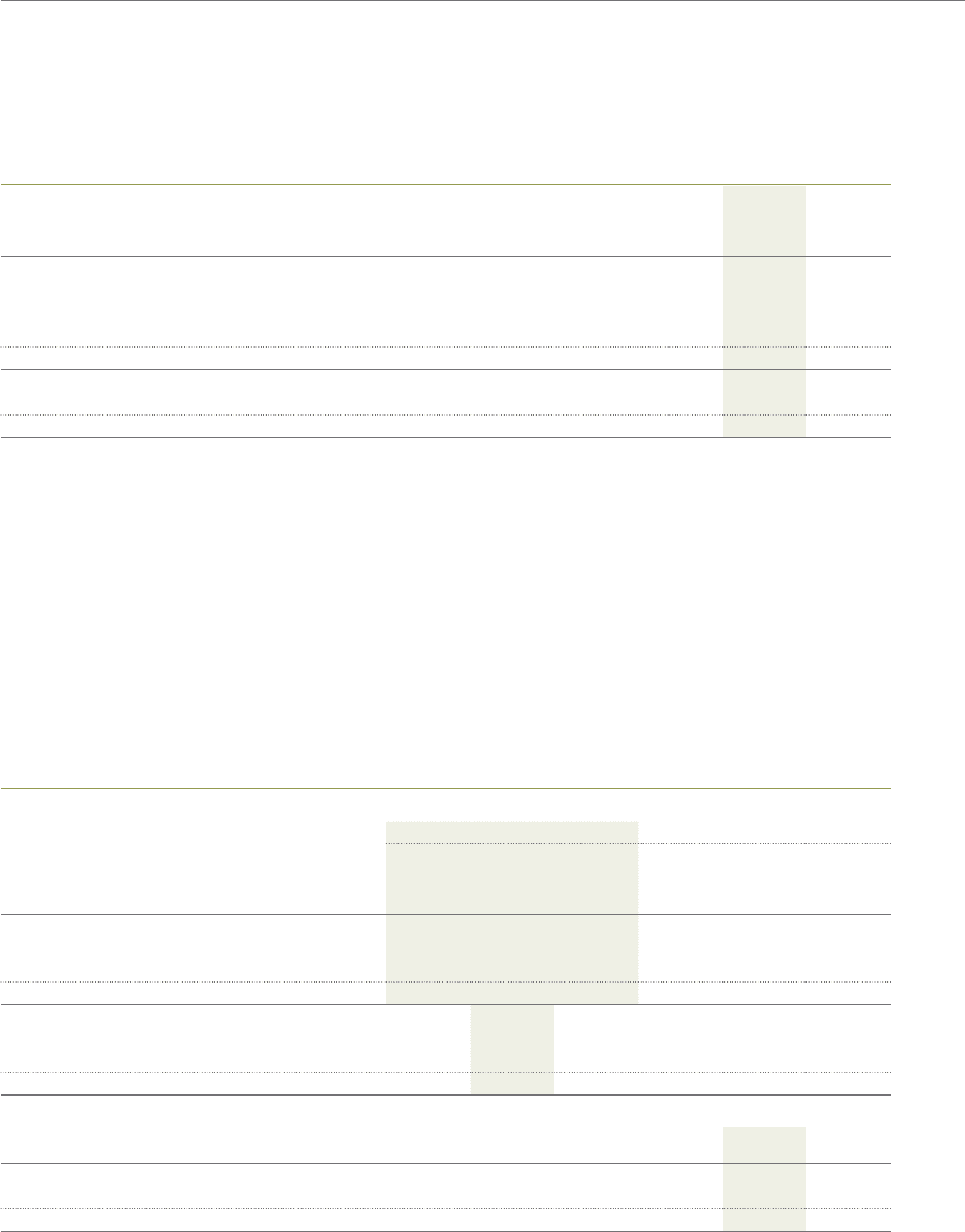

(ii) Reconciliation of the Group tax (credit)/charge to the Benchmark tax charge

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Group tax (credit)/charge (35) 118

One-off tax credit 268 37

Tax attributable to exceptional items (1) 4

Tax relief on total adjustments made to derive Benchmark PBT 42 39

Tax on Benchmark PBT 274 198

Benchmark PBT 1,128 920

Effective rate of tax based on Benchmark PBT 24.3% 21.5%

In the year ended 31 March 2012, a one-off tax credit of US$268m has been recognised on the determination of certain liabilities in respect of

historic positions and the further utilisation of tax losses. In the year ended 31 March 2011, a one-off tax credit of US$37m was recognised in

respect of the utilisation of tax losses. These amounts have been excluded from the calculation of the effective rate of tax based on Benchmark

PBT in view of their size and nature.

(c) Factors that may affect future tax charges

In the foreseeable future, the Group’s tax charge will continue to be influenced by the profile of profits earned in the different countries in which

the Group’s businesses operate and could be affected by changes in tax law. In the UK, the main rate of corporation tax was reduced from

28% to 26% with effect from 1 April 2011 and to 24% with effect from 1 April 2012. Further proposed reductions to the main rate will reduce it by

1% per annum to 22% from 1 April 2014. Each of these further proposed reductions is expected to be separately enacted and has not yet been

substantively enacted.

(d) Other information in respect of tax

Tax recognised in other comprehensive income and directly in equity is detailed in note 16. Details of the tax position in the Group balance sheet

are given in note 35 and an analysis of the cash outflow in respect of tax is given in note 40(d).

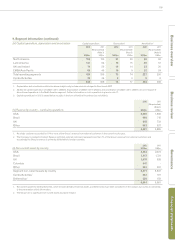

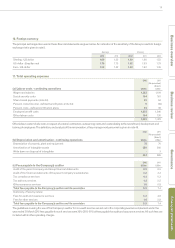

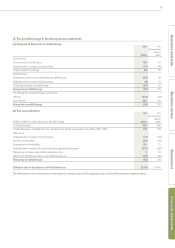

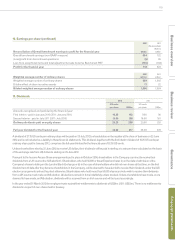

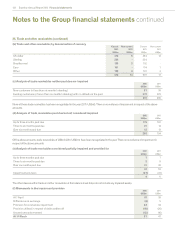

16. Tax recognised in other comprehensive income and directly in equity

(a) Tax recognised in other comprehensive income

2012 2011

Before

tax

US$m

Tax

(charge)

US$m

After

tax

US$m

Before

tax

US$m

Tax

(charge)/

credit

US$m

After

tax

US$m

Actuarial gains - defined benefit pension plans 9(2) 7 107 (30) 77

Fair value gains - available for sale financial assets - - - 4 1 5

Currency translation differences (64) -(64) 142 - 142

Other comprehensive income (55) (2) (57) 253 (29) 224

Current tax -1

Deferred tax (2) (30)

Other comprehensive income (2) (29)

(b) Tax credit recognised directly in equity on transactions with owners

2012

US$m

2011

US$m

Current tax 15 5

Deferred tax 515

20 20

The tax credit recognised directly in equity relates to employee share incentive plans.