Experian 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Governance Financial statementsBusiness reviewBusiness overview

To this end, we recruit talented and diverse

Board members who have the appropriate mix

of skills, capabilities and market knowledge to

ensure Board effectiveness. When recruiting,

we look across all sectors and non-traditional

talent pools and we require diversity of

candidates on our shortlists.

The UK Corporate Governance Code

recommends that we describe the process

used in relation to Board appointments. In

connection with the appointment of our new

independent non-executive directors, Deirdre

Mahlan and George Rose, the process

commenced in September 2011. At that point,

the Nomination and Corporate Governance

Committee reviewed and approved an

outline brief and role specification and

appointed Lygon Group as the search agent

for the assignment. (Lygon have also provided

Board and committee evaluation services and

market research for succession planning).

In discussing the desirable attributes of any

new non-executive director, the Committee

agreed that, if possible, candidates should

possess, among other things, recent and

relevant financial experience. The Committee

also considers diversity when thinking about

the composition of the Board.

Between September 2011 and March 2012,

meetings were held with Lygon to discuss

the specification and the search, an initial

long list of candidates was prepared and

interviews were held. A short list was then

presented to the Committee in March 2012,

and the Committee recommended to the

Board the appointment of Deirdre and George

as non-executive directors in May 2012. At its

May 2012 meeting, the Board appointed both

with effect from 1 September 2012. In due

course, a tailored induction programme will be

developed for the new non-executive directors.

Remuneration Committee report

Roger Davis

Chairman of

Remuneration

Committee

Current members

Roger Davis (Chairman)

Fabiola Arredondo

Alan Jebson

Sir Alan Rudge

Judith Sprieser

David Tyler

Paul Walker

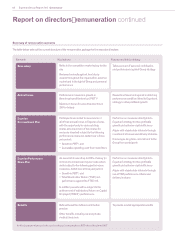

Primary roles

To recommend to the Board senior

management remuneration policy and the

remuneration of the Chairman.

To determine individual remuneration

packages for executive directors and certain

senior executives.

To communicate with shareholders on

remuneration policy.

To review and recommend to the Board the

design of the Group’s short and long-term

incentive plans.

To oversee the Group’s executive pension

arrangements.

Governance

The Remuneration Committee was in place

throughout the year ended 31 March 2012

and met six times, including two ad-hoc

meetings. All of its members are considered

by the Board to be independent non-executive

directors in accordance with provision D.2.1

of the UK Corporate Governance Code.

The Chairman and CEO attend meetings

by invitation. They do not attend when their

individual remuneration is discussed and

no director is involved in deciding his or her

own remuneration. Other regular attendees

include the Group Human Resources Director

and members of the Global Reward team.

The Committee meets regularly with its

independent advisers.

All members of the Committee were provided

with an induction in the role of the Committee

and the operation of its terms of reference on

first appointment.

Activities

At its meetings during the year, the

Committee:

•reviewed incentive arrangements related to

the acquisition of Computec;

•initiated the invitation to employees to

participate in the 2011 Sharesave scheme;

•reviewed the draft report on directors’

remuneration;

•initiated and reviewed feedback from

a shareholder consultation exercise

concerning the proposed performance

measures, targets and operation of the

Company’s long-term incentive plans;

•agreed the 2011 bonus outcome and the

preliminary 2012 bonus targets and those

for long-term incentive awards;

•received updates in respect of the long-

term incentive plans of the Company;

•agreed the participants for certain long-

term incentive plans;

•received an update on corporate

governance issues relevant to

remuneration; and

•agreed to make share plan awards.

The Committee also approved the

proposed remuneration for three new

senior appointments – the new CFO, the

new Managing Director, EMEA and the new

Managing Director, UK and Ireland; reviewed

the fee of the Chairman and the salaries of

the CEO, the COO, the Company Secretary

and a number of senior executives, taking

account of remuneration arrangements

throughout Experian; received general

and regional market overviews; received a

summary of the Group’s global remuneration

position and considerations for the next year,

and reviewed its own performance and terms

of reference.

The report on directors’ remuneration sets

out the way in which the Company has

applied corporate governance principles to

directors’ remuneration.