Experian 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

Governance Financial statementsBusiness reviewBusiness overview

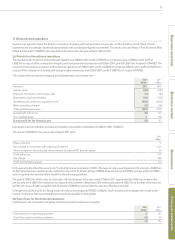

17. Discontinued operations

Experian has agreed to divest the Group’s comparison shopping and lead generation businesses, and the results and cash flows of these

businesses are accordingly classified as discontinued with comparative figures re-presented. The results and cash flows of First American Real

Estate Solutions LLC (‘FARES’) were reported as discontinued in the year ended 31 March 2011.

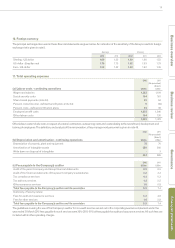

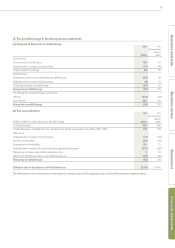

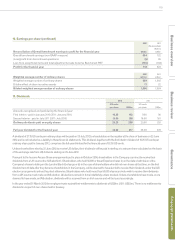

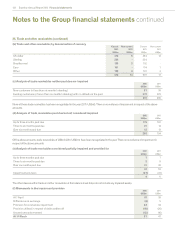

(a) Results for discontinued operations

The loss before tax in respect of discontinued operations of US$9m (2011: profit of US$142m) comprises a loss of US$9m (2011: profit of

US$23m) in respect of the comparison shopping and lead generation businesses and US$nil (2011: profit of US$119m) in respect of FARES. The

loss for the financial year in respect of discontinued operations of US$6m (2011: profit of US$85m) comprises US$6m (2011: profit of US$12m) in

respect of the comparison shopping and lead generation businesses and US$nil (2011: profit of US$73m) in respect of FARES.

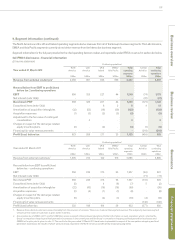

The results of the comparison shopping and lead generation businesses were:

2012

US$m

2011

US$m

Revenue 283 354

Labour costs (44) (49)

Data and information technology costs (7) (8)

Depreciation and amortisation (32) (35)

Marketing and customer acquisition costs (201) (225)

Other operating charges (8) (14)

Total operating expenses (292) (331)

(Loss)/profit before tax (9) 23

Tax credit/(charge) 3 (11)

(Loss)/profit for the financial year (6) 12

Depreciation and amortisation includes amortisation of acquisition intangibles of US$27m (2011: US$30m).

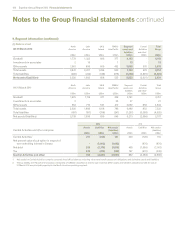

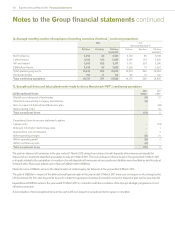

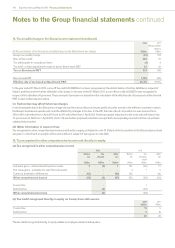

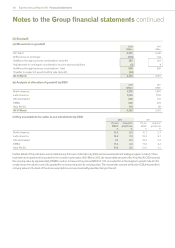

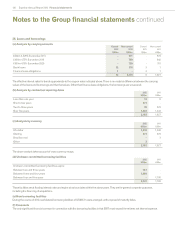

The results of FARES for the year ended 31 March 2011 were:

2011

US$m

Share of profits 5

Gain arising in connection with disposal of interest 123

Finance expense - financing fair value reversal arising on FAC buy-out option (9)

Profit before tax 119

Tax charge (46)

Profit for the financial year 73

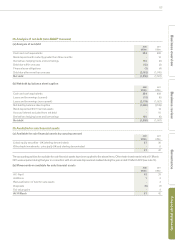

In the period to the date of the exercise by The First American Corporation (’FAC’) of its buy-out option over Experian’s 20% interest in FARES on

22 April 2010, Experian used the equity method to account for its shareholding in FARES. Experian’s share of FARES’ post-tax profits of US$5m

was recognised and reported within results for discontinued operations.

The gain of US$123m which arose in connection with this disposal in the year ended 31 March 2011 represented the difference between the

pre-tax amount of US$314m realised on the disposal of the interest in December 2010 and its book value of US$217m at the date of the exercise

by FAC of its buy-out option, together with dividends of US$26m received after the exercise of the buy-out option.

In the period to 22 April 2010, the Group made net sales and recharges to FARES of US$2m. Such net sales and recharges were made under

normal commercial terms and conditions that would be available to third parties.

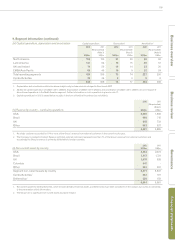

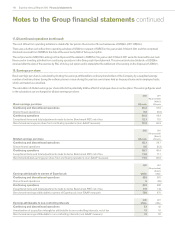

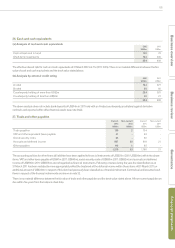

(b) Cash flows for discontinued operations

Cash flows for the comparison shopping and lead generation businesses comprise:

2012

US$m

2011

US$m

Cash inflow from operating activities 255

Cash flow used in investing activities (3) (5)

(1) 50