Experian 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

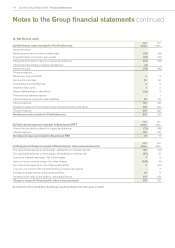

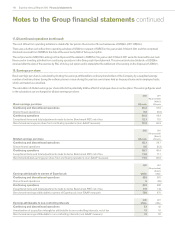

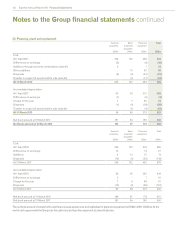

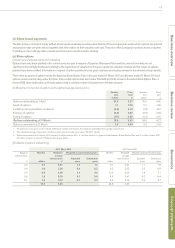

25. Trade and other receivables (continued)

(b) Trade and other receivables by denomination of currency

Current

2012

US$m

Non-current

2012

US$m

Current

2011

US$m

Non-current

2011

US$m

US dollar 310 6 294 13

Sterling 236 - 234 -

Brazilian real 135 3 152 -

Euro 101 - 114 1

Other 128 4 107 3

910 13 901 17

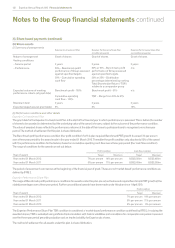

(c) Analysis of trade receivables neither past due nor impaired

2012

US$m

2011

US$m

New customers (of less than six months’ standing) 37 35

Existing customers (of more than six months’ standing) with no defaults in the past 373 370

410 405

None of these trade receivables has been renegotiated in the year (2011: US$nil). There is no evidence of impairment in respect of the above

amounts.

(d) Analysis of trade receivables past due but not considered impaired

2012

US$m

2011

US$m

Up to three months past due 175 167

Three to six months past due 21 14

Over six months past due 12 13

208 194

Of the above amounts, trade receivables of US$nil (2011: US$2m) have been renegotiated in the year. There is no evidence of impairment in

respect of the above amounts.

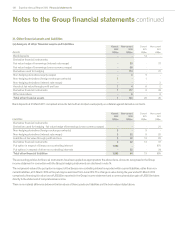

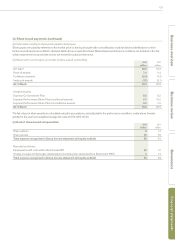

(e) Analysis of trade receivables considered partially impaired and provided for

2012

US$m

2011

US$m

Up to three months past due 77

Three to six months past due 38

Over six months past due 31 38

41 53

Impairment provision (37) (47)

4 6

The other classes within trade and other receivables at the balance sheet dates do not include any impaired assets.

(f) Movements in the impairment provision

2012

US$m

2011

US$m

At 1 April 47 38

Differences on exchange (4) 5

Provision for receivables impairment 24 34

Provision utilised in respect of debts written off (18) (20)

Unused amounts reversed (12) (10)

At 31 March 37 47