Experian 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Experian Annual Report 2012 Business review

Group income statement commentary

Revenue and profit performance –

continuing operations

Revenue increased from US$3,885m in the

prior year to US$4,487m in the year ended

31 March 2012. At constant exchange rates,

organic revenue growth was 10%.

Profit before tax increased by 5%, from

US$656m to US$689m. Benchmark PBT

rose by US$208m to US$1,128m (2011:

US$920m).

Organic revenue growth of 10%, together

with the benefit of acquisition activity,

translated into growth in total EBIT at

constant exchange rates of 19% to

US$1,175m, with a margin improvement

of 50 basis points to 26.2%.

Exceptional items - continuing operations

The gain on disposal of businesses in the

year related to a number of small disposals

of businesses, principally the disposal of an

investment classified as available for sale at

31 March 2011.

Net interest expense

In the year ended 31 March 2012, the

net interest expense was US$47m (2011:

US$71m), after crediting US$11m (2011:

US$6m) in respect of the difference between

the expected return on pension plan assets

and interest recognised on pension plan

obligations. We have continued to benefit

from the environment of low global interest

rates and our strong cash flow performance.

Tax

The effective rate of tax for the year based

on Benchmark PBT was 24.3% (2011: 21.5%).

The increase reflects a larger proportion

of Benchmark PBT from higher tax rate

jurisdictions. This rate is defined as the total

tax charge reported in the Group income

statement, adjusted for the tax impact of non-

benchmark items, divided by Benchmark

PBT.

In the year ended 31 March 2012, a one-off

tax credit of US$268m has been recognised

on the determination of certain liabilities in

respect of historic positions and the further

utilisation of tax losses. In the year ended

31 March 2011, a one-off tax credit of US$37m

was recognised in respect of the utilisation

of tax losses. These amounts have been

excluded from the calculation of the effective

rate of tax based on Benchmark PBT in view

of their size and nature.

Earnings and dividends per share

Basic earnings per share were 66.2 US cents

(2011: 57.9 US cents). Basic earnings for the

year included a loss per share of 0.6 US cents

(2011: earnings of 8.5 US cents) in respect

of discontinued operations. Benchmark

earnings per share increased to 78.9 US cents

from 66.9 US cents last year.

The second interim dividend for the year, to

be paid on 20 July 2012, is 21.75 US cents per

ordinary share (2011: 19 US cents) giving a

total dividend per share for the year of 32 US

cents (2011: 28 US cents), an increase of 14%.

The total dividend is covered 2.5 times by

Benchmark earnings per share.

Financial review

Experian has delivered another year of strong financial performance as

our global growth programme gains pace and has reported strong revenue

growth and good profit and cash flow performance.

Key financials

Year ended 31 March 2012 2011

Revenue US$4,487m US$3,885m

Benchmark PBT US$1,128m US$920m

Benchmark tax rate 24.3% 21.5%

Benchmark EPS US 78.9c US 66.9c

Operating cash flow US$1,124m US$975m

Net debt US$1,818m US$1,501m

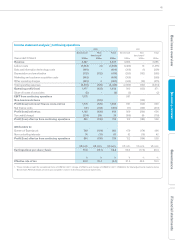

Exceptional items – continuing operations

Year ended 31 March

2012

US$m

2011

US$m

Gain/(loss) on disposal of businesses 8(21)

Interest income on legacy tax balances 4-

Gain in respect of defined benefit pension plan -29

Restructuring costs -(10)

Total exceptional items 12 (2)