Experian 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

Governance Financial statementsBusiness reviewBusiness overview

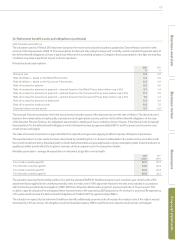

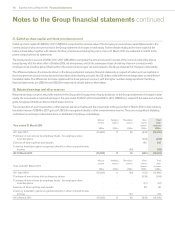

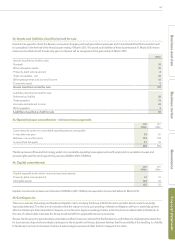

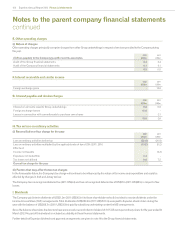

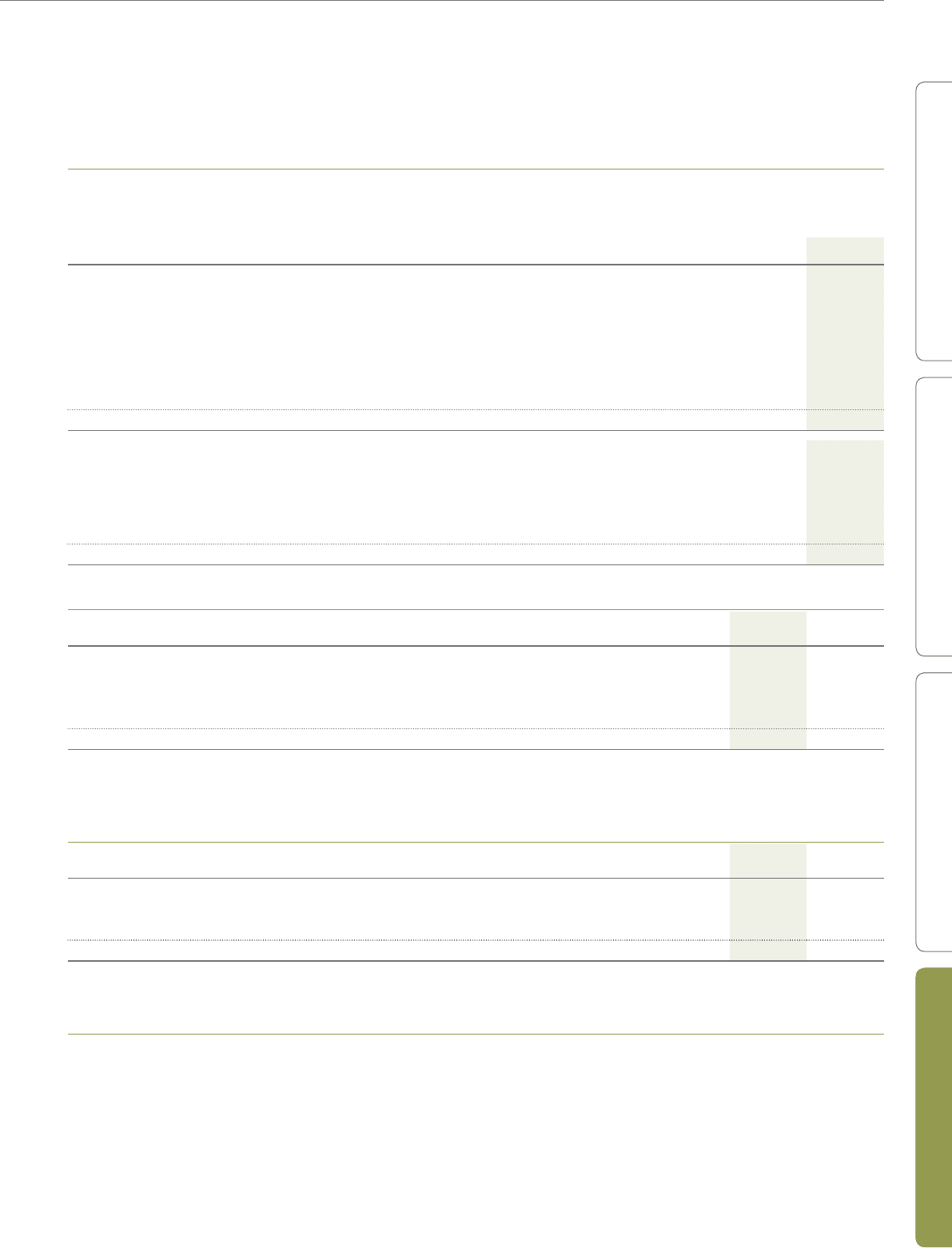

42. Assets and liabilities classified as held for sale

Experian has agreed to divest the Group’s comparison shopping and lead generation businesses and it is anticipated that this transaction will

be completed in the first half of the financial year ending 31 March 2013. The assets and liabilities of these businesses at 31 March 2012 shown

below are classified as held for sale. Any gain on disposal will be recognised in the year ending 31 March 2013.

US$m

Assets classified as held for sale:

Goodwill 33

Other intangible assets 35

Property, plant and equipment 8

Trade receivables - net 22

Other prepayments and accrued income 15

Current tax asset 5

Assets classified as held for sale 118

Liabilities classified as held for sale:

Deferred tax liability 38

Trade payables 15

Accruals and deferred income 24

Other payables 3

Liabilities classified as held for sale 80

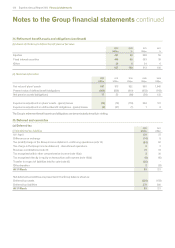

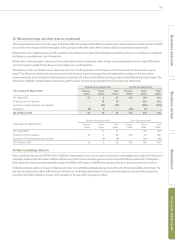

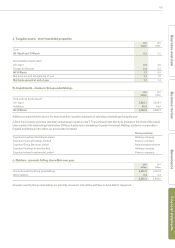

43. Operating lease commitments - minimum lease payments

2012

US$m

2011

US$m

Commitments under non-cancellable operating leases are payable:

In less than one year 63 52

Between one and five years 138 134

In more than five years 67 78

268 264

The Group leases offices and technology under non-cancellable operating lease agreements with varying terms, escalation clauses and

renewal rights and the net charge for the year was US$69m (2011: US$59m).

44. Capital commitments

2012

US$m

2011

US$m

Capital expenditure for which contracts have been placed:

Property, plant and equipment 34 23

Intangible assets 128 30

162 53

Capital commitments include commitments of US$104m (2011: US$nil) not expected to be incurred before 31 March 2013.

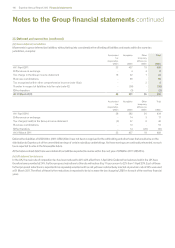

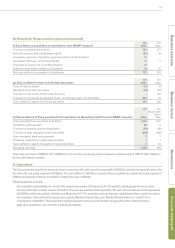

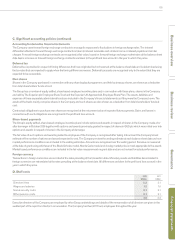

45. Contingencies

There are a number of pending and threatened litigation claims involving the Group in North America and Latin America which are being

vigorously defended. The directors do not believe that the outcome of any such pending or threatened litigation will have a materially adverse

effect on the Group’s financial position. However, as is inherent in legal proceedings, there is a risk of outcomes unfavourable to the Group. In

the case of unfavourable outcomes the Group would benefit from applicable insurance recoveries.

Serasa, the Group’s principal subsidiary undertaking in Brazil, has been advised that the Brazilian tax authorities are challenging the deduction

for tax purposes of goodwill amortisation arising from the acquisition of Serasa. Experian believes that the possibility of this resulting in a liability

to the Group is remote on the basis of advice of external legal counsel and other factors in respect of the claim.