Experian 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

GovernanceBusiness reviewBusiness overview Financial statements

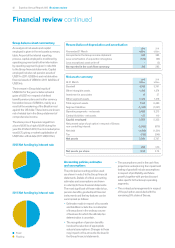

Cash flow, funding and net debt

We generated good cash flow in the year

with operating cash flow of US$1,124m (2011:

US$975m) and a cash flow conversion of

96% (2011: 98%). Working capital and capital

expenditure is managed in order to meet a

target to convert at least 90% of EBIT into

operating cash flow and this target forms

a key performance indicator. Cash flow

conversion is defined as operating cash flow

expressed as a percentage of EBIT from

continuing operations and a reconciliation

of cash generated from operations as

reported in the Group cash flow statement to

operating cash flow as reported in the cash

flow summary table is given in note 40 to the

Group financial statements.

As indicated in the cash flow summary table,

free cash flow in the year ended 31 March

2012 was US$889m (2011: US$742m). The net

cash outflow in the year of US$182m (2011:

inflow of US$458m) is after acquisition spend

of US$787m (2011: US$301m) and equity

dividends of US$290m (2011: US$251m).

Capital expenditure was US$453m (2011:

US$369m) including data and software

to support future growth. An analysis by

operating segment is given in note 9(b) to the

Group financial statements.

During the course of the year, new bilateral

borrowing facilities of US$617m were

arranged, with a spread of maturity dates.

At 31 March 2012, net debt was US$1,818m

(2011: US$1,501m) with undrawn committed

borrowing facilities of US$2,147m (2011:

US$1,700m). At 31 March 2012 the adjusted

net debt/EBITDA ratio, including the value

of the Serasa put option at that date of

US$1,092m, was 2.0 times. The maturity

profile of loans and borrowings and facilities

is shown in note 28 to the Group financial

statements.

There have been no defaults under any

covenants given on loans or borrowings

in the year under review or the prior year

and there is no undue concentration of

repayment obligations in respect of debt

instruments.

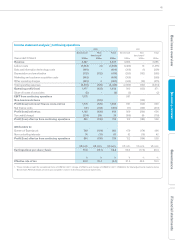

Cash flow summary

Year ended 31 March

2012

US$m

2011

US$m

EBIT from continuing operations 1,175 991

Depreciation and amortisation 312 283

Loss on sale of fixed assets 45

Capital expenditure (453) (369)

Sale of property, plant and equipment 37

Decrease in working capital 20 4

Loss retained in associates 33

Charge in respect of equity incentive plans within

Benchmark PBT 60 51

Operating cash flow 1,124 975

Net interest paid (57) (92)

Tax paid (107) (85)

Dividends paid to non-controlling interests (71) (56)

Free cash flow 889 742

Net cash outflow from exceptional items (5) (20)

Acquisitions (787) (301)

Purchase of investments (1) (3)

Disposal of investment in FARES – discontinued operations -279

Disposal of available for sale financial assets 12 -

Disposal of businesses – continuing operations -12

Equity dividends paid (290) (251)

Net cash (outflow)/inflow (182) 458

Net share purchases (167) (349)

New borrowings and other financing related cash flows 187 72

Net (decrease)/increase in cash and cash equivalents -

continuing operations (162) 181

Net (decrease)/increase in cash and cash equivalents -

discontinued operations (1) 52

Net (decrease)/increase in cash and cash equivalents (163) 233

Cash and cash equivalents at 1 April 408 163

Foreign exchange movements on cash and cash equivalents 912

Cash and cash equivalents at 31 March 254 408

Reconciliation of net debt

Year ended 31 March

2012

US$m

2011

US$m

At 1 April 1,501 1,627

Net cash inflow/(outflow) – as reported in the cash flow summary 182 (458)

Net share purchases 167 349

Foreign exchange and other (32) (17)

At 31 March 1,818 1,501