Experian 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Governance Financial statementsBusiness reviewBusiness overview

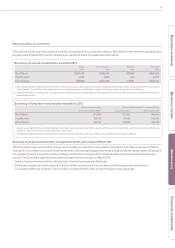

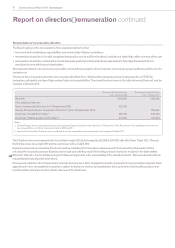

Salary to

31 March 2012

Salary from

1 April 2012

Percentage

increase

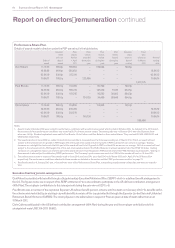

Don Robert US$1,500,000 US$1,550,000 3.3%

Chris Callero US$960,000 US$990,000 3.1%

Brian Cassin1–£450,000 –

1. Brian Cassin’s salary is from 30 April 2012 when he joined the Company.

Service contracts

Each executive director has a rolling service contract which can be terminated by the Group giving twelve months’ notice. In the event of

termination of the director’s contract, any compensation payment is calculated in accordance with normal legal principles, including the

application of mitigation to the extent appropriate in the circumstances of the case. Further details are provided in the section entitled ‘Executive

directors’ service contracts’.

Fixed remuneration

Base salary and benefits

Before making a final decision on individual salary awards, the Committee assesses each director’s individual performance and experience as

well as average pay increases awarded to other employees in the Group. To assess the appropriate salary for a role, benchmark data, sourced

from external remuneration consultants, is provided to the Committee. Executive directors’ salaries are benchmarked against those of executive

directors from the companies in the FTSE 100 Index along with other global comparators, reflecting the markets from which Experian recruits

talent. These include, but are not limited to, international companies of a similar size and geographic scope, companies in the financial services

and related industries and companies with significant operations in the same markets as Experian.

The Committee reviewed salaries in early 2012 and, taking into account the factors described above, approved increases as detailed below.

These increases are in line with those awarded to the wider employee population.

In addition to base salary, executive directors receive certain benefits-in-kind including a car or car allowance, private health cover and life

assurance. These are set at market competitive levels for each role.

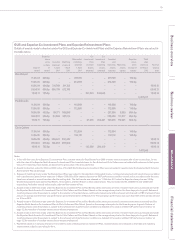

Pensions

In the UK, a defined contribution plan is available for all employees, with an employer contribution rate (in normal circumstances) of up to 20%

for the most senior executives. Retirement age is 65 but benefits can be taken from age 55 onwards.

The UK defined benefit arrangements are closed to new entrants, subject only to exceptions approved by the Committee on a case by case

basis. There are no directors who are members of the UK defined benefit scheme.

In the US, Experian provides a Personal Investment Plan (401k) which all US employees, including directors, are eligible to join. This is a defined

contribution arrangement to which participants are able to contribute up to 50% of salary, up to a maximum salary and participant contribution

limit established by the IRS, each calendar year. A supplementary unfunded defined benefit arrangement is provided in the US for Don Robert.

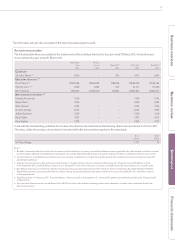

Variable remuneration

Annual bonus

Annual bonuses are awarded for achieving profit growth targets. The Committee believes this is appropriate as it reflects one of Experian’s

key strategic objectives (driving profitable growth). The maximum bonus opportunity for executive directors is 200% of base salary. However,

this level of annual bonus is only payable if Experian’s financial performance surpasses stretching profit growth targets, designed to deliver

exceptional results to shareholders. The calibration of these targets is based on benchmarks that reflect stretching internal and external

expectations. The benchmarks considered include: broker earnings estimates, earnings estimates for competitors, latest projections for the

current year, budget and strategic plan.

Annual bonus in respect of the year ended 31 March 2012

The Committee set targets for the annual bonus in respect of the year ended 31 March 2012 which required stretching levels of performance

(with reference to relevant external benchmarks) in order for maximum bonus to be earned. Experian delivered exceptional profit growth over

the year in an economic environment which continued to be challenging in most of the markets in which we operate. The level of profit growth

achieved exceeded the maximum target set by the Committee and so a bonus of 200% of salary was payable to the executive directors.

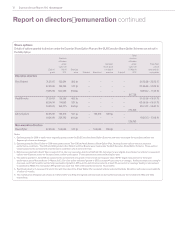

Co-investment Plan

The Experian Co-investment Plan (the ‘CIP’) provides the executive directors with the opportunity to defer between 50% and 100% of their

annual bonus into Experian shares (‘invested shares’) that are matched with an additional award of shares (‘matching shares’) with the

maximum match being calculated on the basis of two matching shares for each invested share (‘2:1 basis’). If no annual bonus is earned in the

year there can be no participation in the CIP. The release of invested shares and matching shares is deferred for three years and the release of

the matching shares is subject to performance conditions which are measured over that period.

P81