Experian 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Experian Annual Report 2012 Governance

Report on directors’ remuneration continued

Reward alignment with risk considerations

Co-investment /

Deferral

Between 50% and 100% of the annual bonus may be deferred into shares

for three years. These deferred shares together with shares awarded

under the long-term incentive plan mean that a significant portion of total

remuneration is delivered in the form of shares deferred for a period of

three years.

The executive directors and the vast majority

of senior management invited to participate

have elected to defer their entire annual

bonuses for the year ended 31 March 2012.

Shareholding

requirements

Executive directors are expected to build up and maintain a shareholding

of at least 100% of salary (200% for the CEO).

The shareholdings of Don Robert and

Chris Callero greatly exceed the minimum

requirement.

Clawback Vesting of awards made under the Experian Performance Share Plan and

matching awards under the Experian Co-investment Plan will only occur

if the Committee is satisfied that the vesting is not based on any material

misstatement of accounts; and

Where any bonus is paid which is ultimately found to have been based

on materially misstated financial results, the bonus opportunity may be

reduced accordingly in the following financial year.

This feature was introduced for incentive

plan grants in June 2011 and will be in place

for future awards.

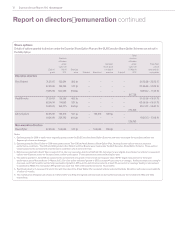

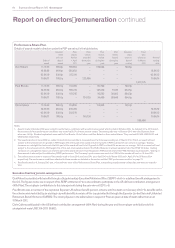

Expected value of executive directors’

remuneration at target performance

Variable: long-term

Variable: short-term

Fixed

100%

80%

60%

40%

20%

0%

Expected value of executive directors’

remuneration at maximum performance

Variable: long-term

Variable: short-term

Fixed

100%

80%

60%

40%

20%

0%

With respect to Responsible Investment Disclosure, the Committee is satisfied that environmental, social and governance risks are not raised

by the incentive structure for senior management and this does not inadvertently motivate irresponsible behaviour.

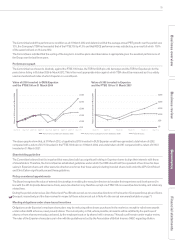

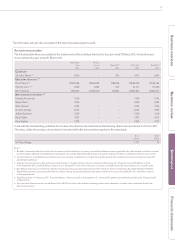

Remuneration of executive directors

The following graphs illustrate the remuneration package for the executive directors, split between fixed and variable pay, at target and

maximum levels of performance. The combined potential remuneration from annual bonus and share-based incentives (i.e. variable pay)

outweighs the fixed elements (excluding pension and benefits) at both levels of performance. As the relativities of the fixed and variable

elements are the same for each executive director we have not provided graphs on an individual basis.

The Committee believes reward at Experian is appropriately balanced against risk considerations, particularly in the following areas: