Experian 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Governance Financial statementsBusiness reviewBusiness overview

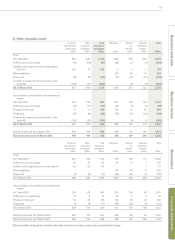

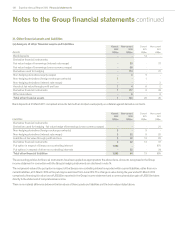

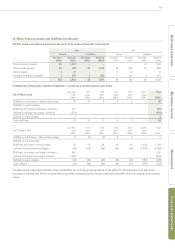

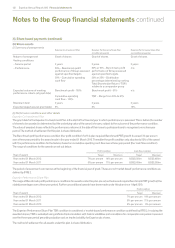

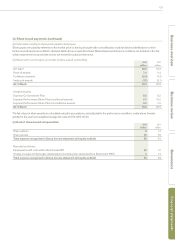

33. Share-based payments

The Group has a number of equity settled, share-based employee incentive plans. Details of the arrangements under which options are granted

and awards made are given below, together with information on their valuation and cost. The price of the Company’s ordinary shares is quoted

in sterling and accordingly option, award and share prices are disclosed in sterling.

(a) Share options

(i) Summary of arrangements and valuations

Options have only been granted in the current and prior year in respect of Experian Sharesave Plans and the amounts involved are not

significant. Accordingly disclosures relating to the application of valuation techniques, inputs into valuation models and fair values of options

granted have been omitted. Information in respect of options granted in prior years has been previously provided in the relevant annual reports.

There were no grants of options under the Experian Share Option Plan in the year ended 31 March 2012 and the year ended 31 March 2011 but

options remain outstanding under this plan. Fully vested options also exist under The GUS plc North America Executive Stock Option Plan, a

former GUS share option plan, and these options had a maximum term of six years from the date of grant.

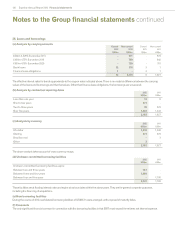

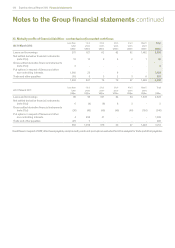

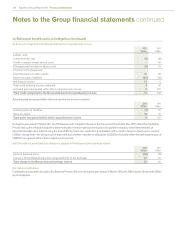

(ii) Movement in number of options and weighted average exercise price

Number

2012

million

Price

2012

£

Number

2011

million

Price

2011

£

Options outstanding at 1 April 24.8 4.27 35.3 4.42

Grant of options 1.1 6.16 0.7 4.85

Forfeiture and cancellation of options1(0.9) 4.74 (1.8) 4.01

Exercise of options2(9.9) 3.87 (8.9) 4.94

Expiry of options (0.1) 4.85 (0.5) 4.91

Options outstanding at 31 March 15.0 4.63 24.8 4.27

Options exercisable at 31 March 3.8 4.54 5.9 5.16

1. For plans of a ‘save as you earn’ nature, forfeitures include non-leavers who have not completed the savings requirement.

2. The weighted average share price of options exercised during the year was £7.84 (2011: £6.90).

3. Options exercisable at 31 March 2012 include 0.1 million shares (2011: 0.1 million shares) in respect of the Experian Share Option Plan and 3.7 million shares (2011:

5.8 million shares) in respect of Experian Sharesave Plans.

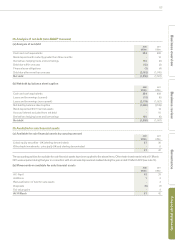

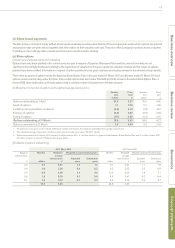

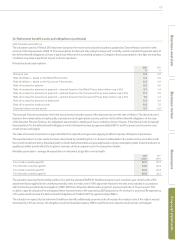

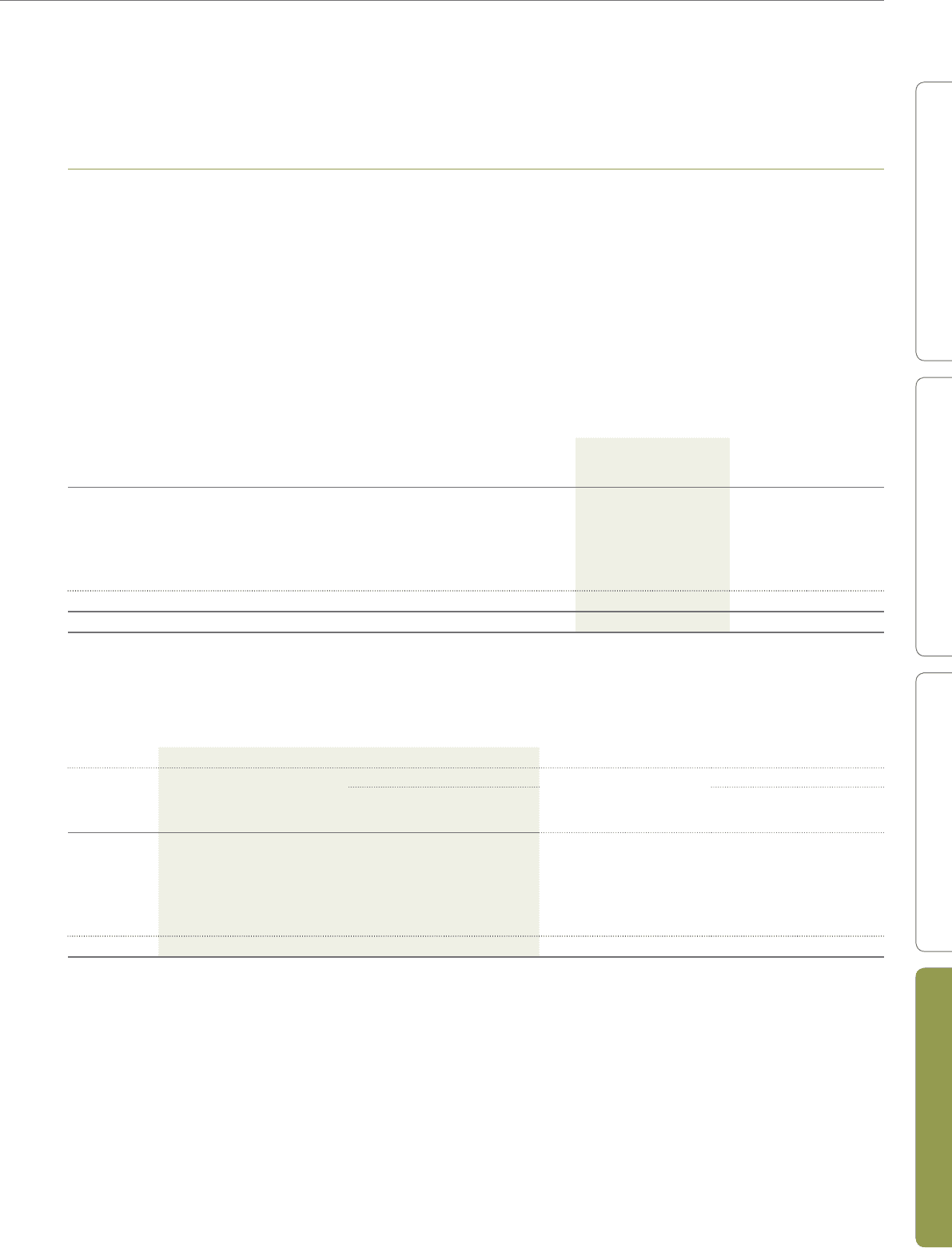

(iii) Details of options outstanding

At 31 March 2012 At 31 March 2011

Range of

exercise prices

£

Number

million

Weighted

average

exercise price

£

Weighted average remaining lives Number

million

Weighted

average

exercise price

£

Weighted average remaining lives

Expected

years

Contractual

years

Expected

years

Contractual

years

2-3 0.7 2.91 1.3 1.7 2.1 2.91 1.1 1.5

3-4 1.6 3.36 0.4 6.3 6.5 3.23 1.2 6.9

4-5 9.8 4.66 1.1 9.1 12.0 4.65 1.9 7.1

5-6 1.9 5.39 0.1 6.6 4.0 5.41 0.2 4.4

6-7 1.0 6.18 2.7 3.3 0.2 6.13 0.3 6.1

15.0 4.63 24.8 4.27