Experian 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

120 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

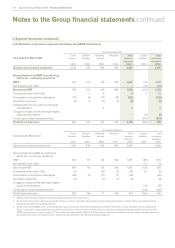

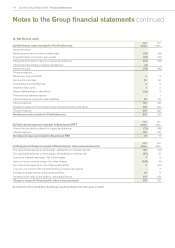

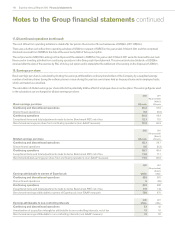

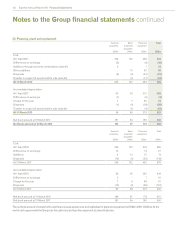

20. Goodwill

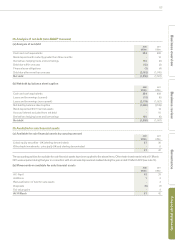

(a) Movements in goodwill

2012

US$m

2011

US$m

At 1 April 3,761 3,412

Differences on exchange (115) 144

Additions through business combinations (note 41) 553 201

Adjustments to contingent consideration on prior year acquisitions (3) 4

Additions through business combinations - total 550 205

Transfer in respect of assets held for sale (note 42) (33) -

At 31 March 4,163 3,761

(b) Analysis of allocation of goodwill by CGU

2012

US$m

2011

US$m

North America 1,778 1,675

Latin America 1,322 1,116

UK and Ireland 686 611

EMEA 262 270

Asia Pacific 115 89

At 31 March 4,163 3,761

(c) Key assumptions for value-in-use calculations by CGU

2012 2011

Pre-tax

WACC

%

Long-term

growth rate

%

Pre-tax

WACC

%

Long-term

growth rate

%

North America 11.3 2.3 12.7 2.3

Latin America 14.8 7.0 16.4 6.7

UK and Ireland 9.1 2.3 10.4 2.3

EMEA 11.4 4.3 11. 2 4.3

Asia Pacific 11.6 5.3 12.0 5.1

Further details of the principles used in determining the basis of allocation by CGU and annual impairment testing are given in note 6. There

have been no impairments of goodwill in the current or prior years. At 31 March 2012, the recoverable amount of the Asia Pacific CGU exceeds

the carrying value by approximately US$80m and an increase in the pre-tax WACC of 1.3% or a reduction in the long-term growth rate of 1.9%

would reduce the value-in-use of its goodwill to an amount equal to its carrying value. The recoverable amount of the other CGUs exceed their

carrying value on the basis of the above assumptions and any reasonably possible changes thereof.