Experian 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Experian Annual Report 2012 Governance

Report on directors’ remuneration

Chairman’s introduction

and highlights

The Committee, whose membership,

remit and responsibilities are set out in

the statement on corporate governance,

continues to assess how best to support

and encourage the executive directors to

create shareholder value and ensure that the

Group’s remuneration policy is aligned with

shareholders’ interests. Our report sets out

how we believe that we achieve this.

During the past year the salaries of the

executive directors were increased by

some 3% which was in line with the wider

employee population. The Committee was

mindful of the pay restraint which had been

exercised across the Group and will ensure

that future salary rises will continue to be

positioned from this perspective.

Sadly during the year, Paul Brooks, Chief

Financial Officer, died and he was succeeded

by Brian Cassin who joined the Board on

30 April 2012. The Committee approved the

remuneration arrangements for Brian Cassin

and further details are set out in the relevant

sections of this report.

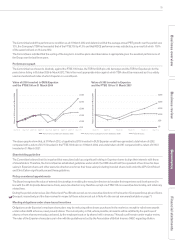

Encouragingly, the Group has once

again delivered a strong set of results for

shareholders with Benchmark profit before

tax of US$1,128m, up 23% on the prior year.

As a result a full bonus was payable to the

executive directors. The Committee had set

stretching targets at the beginning of the year

and required material outperformance for the

payout that was earned.

This underlines our view that exceptional

rewards are only paid for exceptional

performance. Don Robert and Chris Callero

have elected to defer 100% of their bonus

into the Co-investment Plan, as they always

have done, which the Committee welcomes

as a strong signal of their confidence in the

Company and further strengthening of their

alignment of interests with those

of shareholders.

Performance over the longer-term has also

been strong, delivering average annual

growth in benchmark profit before tax

and earnings per share of 12% and 9.7%

respectively over the last three years.

The relevant performance conditions for long-

term incentive awards granted in June 2009

were measured at 31 March 2012 and, as a

result, awards under the Performance Share

Plan, Share Option Plan and Co-investment

Plans will vest on 18 June 2012.

The Committee is of the opinion that

the executive directors are rewarded

appropriately and that their remuneration

recognises their contribution to the ongoing

success of the Group.

We continue to set performance targets

that are robust but achievable and we are

careful that they are of equivalent stretch

from year to year whatever the change in the

economic climate or trading conditions.

Above all, the Committee seeks to balance

the interests of all stakeholders and is

hopeful that shareholders will be able to

endorse its activities by supporting the

resolution to approve this report on directors’

remuneration which will be proposed at the

annual general meeting on 18 July 2012.

“Experian’s remuneration philosophy is that

reward should be used to drive long term,

sustainable business performance.”

Roger Davis

Chairman of the Remuneration Committee

The Remuneration Committee is pleased to present its annual report on

directors’ remuneration.

P63

P30