Experian 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

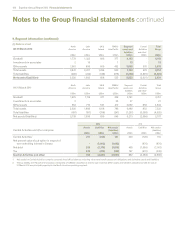

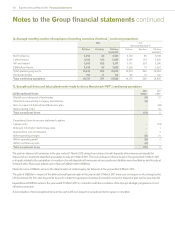

6. Critical accounting estimates and judgments (continued)

The most significant of these judgments is in respect of intangible assets where certain costs incurred in the developmental phase of an

internal project are capitalised if a number of criteria are met. Management has made certain judgments and assumptions when assessing

whether a project meets these criteria, and on measuring the costs and the economic life attributed to such projects. On acquisition, specific

intangible assets are identified and recognised separately from goodwill and then amortised over their estimated useful lives. These include

such items as brand names and customer lists, to which value is first attributed at the time of acquisition. The capitalisation of these assets and

the related amortisation charges are based on judgments about the value and economic life of such items. The economic lives for intangible

assets are estimated at between three and ten years for internal projects, which include databases, internal use software and internally

generated software, and between two and twenty years for acquisition intangibles. Further details of the amounts of, and movements in, such

assets are given in note 21.

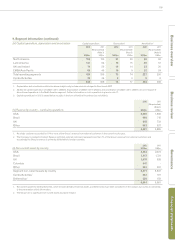

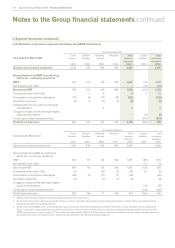

7. Use of non-GAAP measures in the Group financial statements

The Group has identified certain measures that it believes will assist understanding of the performance of the business. The measures are not

defined under IFRS and they may not be directly comparable with other companies’ adjusted measures. The non-GAAP measures are not

intended to be a substitute for, or superior to, any IFRS measures of performance but management has included them as they consider them to

be important comparables and key measures used within the business for assessing performance.

The following are the key non-GAAP measures identified by the Group and used in the Group financial statements:

Benchmark profit before tax (‘Benchmark PBT’)

Benchmark PBT is defined as profit before amortisation of acquisition intangibles, acquisition expenses, goodwill impairments, adjustments

to contingent consideration, charges in respect of the demerger-related equity incentive plans, exceptional items, financing fair value

remeasurements, tax and discontinued operations. It includes the Group’s share of continuing associates’ pre-tax results.

Earnings before interest and tax (‘EBIT’)

EBIT is defined as profit before amortisation of acquisition intangibles, acquisition expenses, goodwill impairments, adjustments to contingent

consideration, charges in respect of the demerger-related equity incentive plans, exceptional items, net finance costs, tax and discontinued

operations. It includes the Group’s share of continuing associates’ pre-tax results.

Benchmark earnings

Benchmark earnings represents Benchmark PBT less attributable tax and non-controlling interests. Benchmark earnings attributable to non-

controlling interests represents that portion of Benchmark earnings that relate to non-controlling interests. Benchmark PBT less attributable tax

is designated as overall benchmark earnings. The attributable tax for the purposes of determining benchmark earnings excludes significant tax

credits and charges arising in the year which, in view of their size or nature, are not comparable with previous periods together with tax arising

on exceptional items and on total adjustments made to derive Benchmark PBT.

Benchmark earnings per share (‘Benchmark EPS’)

Benchmark EPS represents Benchmark earnings divided by a weighted average number of shares, and is disclosed to indicate the underlying

profitability of the Group.

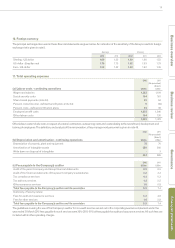

Exceptional items

The separate reporting of non-recurring exceptional items gives an indication of the Group’s underlying performance. Exceptional items

are those arising from the profit or loss on disposal of businesses, closure costs of major business units or costs of significant restructuring

programmes. All other restructuring costs are charged against EBIT in the segments in which they are incurred.

Operating cash flow

Operating cash flow is calculated as cash generated from operations adjusted for outflows in respect of acquisition expenses, the purchase and

disposal of property, plant and equipment and other intangible assets, and adding dividends from continuing associates but excluding any cash

inflows and outflows in respect of exceptional items. It is reconciled to cash generated from operations in note 40(h).

Operating cash flow is defined as EBIT from continuing operations, plus depreciation, amortisation and charges in respect of equity incentive

plans within Benchmark PBT, less capital expenditure net of disposal proceeds and further adjusted for changes in working capital and profit or

loss retained in continuing associates.

Net debt

Net debt is calculated as total debt less cash and cash equivalents and other highly liquid bank deposits with original maturities greater than

three months. Total debt includes loans and borrowings (and the fair value of derivatives hedging loans and borrowings), overdrafts and

obligations under finance leases. Accrued interest is excluded from net debt.