Big Lots 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

If we are unable to retain existing and secure suitable new store locations under favorable lease terms, our financial

performance may be negatively affected.

We lease almost all of our stores and a significant number of these leases expire or are up for renewal each year, as noted below

in “Item 2. Properties” in this Form 10-K. Our strategy to improve our financial performance includes sales growth while

managing the occupancy cost of each of our stores. The primary component of our sales growth strategy revolves around

increasing our comparable store sales, which will require renewing many leases each year. Additional components of our sales

growth strategy are to relocate certain stores to a new location within an existing market and to open new store locations, either

as an expansion in an existing market or as an entrance into a new market. If the commercial real estate market does not allow

for us to negotiate favorable lease renewals and new store leases, our financial position, results of operations, and liquidity may

be negatively affected.

Our inability, if any, to comply with the terms of the 2011 Credit Agreement may have a material adverse effect on our

capital resources, financial condition, results of operations, and liquidity.

We have the ability to borrow funds under the 2011 Credit Agreement, and we utilize this ability at various times depending on

operating or other cash flow requirements. The 2011 Credit Agreement contains financial and other covenants, including, but

not limited to, limitations on indebtedness, liens, and investments, as well as the maintenance of a leverage ratio and a fixed

charge coverage ratio. A violation of any of these covenants may permit the lenders to restrict our ability to further access

loans and letters of credit and may require the immediate repayment of any outstanding loans. Our failure to comply with these

covenants may have a material adverse effect on our capital resources, financial condition, results of operations, and liquidity.

A significant decline in our operating profit and taxable income may impair our ability to realize the value of our long-lived

assets and deferred tax assets.

We are required by accounting rules to periodically assess our property and equipment and deferred tax assets for impairment

and recognize an impairment loss or valuation charge, if necessary. In performing these assessments, we use our historical

financial performance to determine whether we have potential impairments or valuation concerns and as evidence to support

our assumptions about future financial performance. A significant decline in our financial performance could negatively affect

the results of our assessments of the recoverability of our property and equipment and our deferred tax assets and trigger the

impairment of these assets. Impairment or valuation charges taken against property and equipment and deferred tax assets

could be material and could have a material adverse impact on our capital resources, financial condition, results of operations,

and liquidity (see the discussion under the caption “Critical Accounting Policies and Estimates” in the accompanying MD&A in

this Form 10-K for additional information regarding our accounting policies for long-lived assets and income taxes).

Changes in accounting guidance could significantly affect our results of operations and the presentation of those results.

Changes in accounting standards, including new interpretations and applications of accounting standards, may have adverse

effects on our financial condition, results of operations, and liquidity. The Financial Accounting Standards Board (“FASB”)

has issued and/or adopted new guidance that proposes numerous significant changes to current accounting standards. This new

guidance could significantly change the presentation of financial information and our results of operations. Additionally, the

new guidance may require us to make systems and other changes that could increase our operating costs. Specifically,

implementing future accounting guidance related to leases could require us to make significant changes to our lease

management system or other accounting systems.

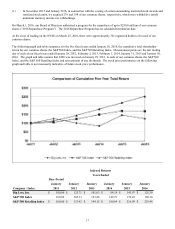

The price of our common shares as traded on the New York Stock Exchange may be volatile.

Our stock price may fluctuate substantially as a result of factors beyond our control, including but not limited to, general

economic and stock market conditions, risks relating to our business and industry as discussed above, strategic actions by our

competitors, variations in our quarterly operating performance, and investor perceptions of the investment opportunity

associated with our common shares relative to other investment alternatives. Additionally, our stock price may reflect the

expectation that we will declare cash dividends at the current level or greater levels in the future. Future dividends are subject

to the discretion of our Board of Directors, and will depend on our financial condition, results of operations, capital

requirements, compliance with applicable laws and agreements and any other factors deemed relevant by our Board. If we fail

to meet any of the expectations related to future growth, profitability, or dividends, our stock price may decline significantly,

which could have a material adverse impact on investor confidence and employee retention.