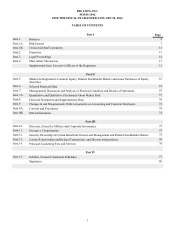

Big Lots 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

If we are unable to compete effectively in the highly competitive discount retail industry, our business and results of

operations may be materially adversely affected.

The discount retail industry, which includes both traditional brick and mortar stores and online marketplaces, is highly

competitive. As discussed in Item 1 of this Form 10-K, we compete for customers, products, employees, real estate, and other

aspects of our business with a number of other companies. Some of our competitors have greater financial, broader distribution

(e.g., more stores and a current online presence), marketing, and other resources than us. It is possible that increased

competition, significant discounting, or improved performance by our competitors may reduce our market share, gross margin,

and operating margin, and may materially adversely affect our business and results of operations.

If we are unable to compete effectively in today’s omnichannel retail marketplace, our business and results of operations

may be materially adversely affected.

With the continued expansion of mobile computing devices, competition from other retailers in the online retail marketplace is

expected to increase. Certain of our competitors, and a number of pure online retailers, have established online operations

against which we compete for customers and products. It is possible that the increasing competition in the online retail space

may reduce our market share, gross margin, and operating margin, and may materially adversely affect our business and results

of operations in other ways. We currently do not offer an omnichannel experience and online retailing. Our current strategic

plan includes providing an omnichannel experience and online retailing capabilities in 2016, which we intend to use to increase

our total net sales. Development and implementation of an online retail channel is a complex undertaking and there is no

guarantee that the resources that we have applied to this effort will result in increased revenues or improved operating

performance. If our online retailing initiatives do not meet our customers’ expectations, the initiatives may reduce our

customers’ desire to purchase goods from us both online and at our brick and mortar stores and may materially adversely affect

our business and results of operations.

Our inability to properly manage our inventory levels and offer merchandise that our customers want may materially impact

our business and financial performance.

We must maintain sufficient inventory levels to successfully operate our business. However, we also must seek to avoid

accumulating excess inventory to maintain appropriate in-stock levels. We obtain approximately one quarter of our

merchandise directly from vendors outside of the U.S. These foreign vendors often require lengthy advance notice of our

requirements to be able to supply products in the quantities that we request. This usually requires us to order merchandise and

enter into purchase order contracts for the purchase of such merchandise well in advance of the time these products are offered

for sale. As a result, we may experience difficulty in responding to a changing retail environment, which makes us vulnerable

to changes in price and in consumer preferences. In addition, we attempt to maximize our operating profit and operating

efficiency by delivering proper quantities of merchandise to our stores in a timely manner. If we do not accurately anticipate

future demand for a particular product or the time it will take to replenish inventory levels, our inventory levels may not be

appropriate and our results of operations may be negatively impacted.

We rely on manufacturers located in foreign countries for significant amounts of merchandise and a significant amount of

our domestically-purchased merchandise is manufactured abroad. Our business may be materially adversely affected by

risks associated with international trade.

Global sourcing of many of the products we sell is an important factor in driving higher operating profit. During 2015, we

purchased approximately 24% of our products directly from overseas vendors, including 20% from vendors located in China,

and a significant amount of our domestically-purchased merchandise is manufactured abroad. Our ability to identify qualified

vendors and to access products in a timely and efficient manner is a significant challenge, especially with respect to goods

sourced outside of the U.S. Global sourcing and foreign trade involve numerous factors and uncertainties beyond our control

including increased shipping costs, increased import duties, more restrictive quotas, loss of most favored nation trading status,

currency and exchange rate fluctuations, work stoppages, transportation delays, economic uncertainties such as inflation,

foreign government regulations, political unrest, natural disasters, war, terrorism, trade restrictions (including retaliation by the

United States against foreign practices), political instability, the financial stability of vendors, merchandise quality issues, and

tariffs. These and other issues affecting our international vendors could materially adversely affect our business and financial

performance.