Big Lots 2015 Annual Report Download - page 63

Download and view the complete annual report

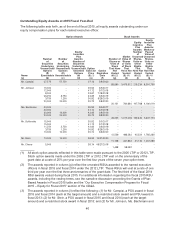

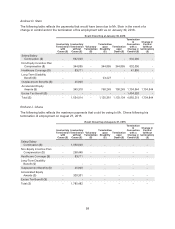

Please find page 63 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(3) The amounts in this column are not included in the Summary Compensation Table as these

amounts reflect only the earnings on the investments designated by the named executive officer

in his or her Supplemental Savings Plan account in fiscal 2015 (i.e., appreciation or decline in

account value). The amounts in this column do not include any above-market or preferential

earnings, as defined by Item 402(c)(2)(viii) of Regulation S-K and the instructions thereto.

(4) $50,481, $152,963, $49,673 and $34,094 of the amounts in this column were previously reported

as compensation to Mr. Campisi, Mr. Johnson, Ms. Bachmann and Mr. Schlonsky, respectively,

in the Summary Compensation Table for the prior years reported.

Potential Payments Upon Termination or Change in Control

The “Rights Under Post-Termination and Change in Control Arrangements” section below addresses

the rights of our named executive officers under their employment agreements and other

compensation arrangements upon a change in control or in the event their employment with us is

terminated. The “Estimated Payments if Triggering Event Occurred at 2015 Fiscal Year End” section

below reflects the payments that may be received by each executive (or his or her beneficiaries, as

applicable) upon a change in control or in the event the executive’s employment with us is terminated:

(1) involuntarily without cause (including a constructive termination (as defined in the Severance

Plan)); (2) in connection with the executive’s disability; (3) upon the executive’s death; (4) upon the

executive’s retirement (none of our named executive officers were retirement eligible at the end of

fiscal 2015); or (5) in connection with a change in control.

Rights Under Post-Termination and Change in Control Arrangements

Termination for Cause

If a named executive officer who is a party to an employment agreement with us (Mr. Campisi and

Ms. Bachmann) is terminated for cause or due to his or her voluntary resignation, we have no

obligation under the employment agreement to pay any unearned compensation or to provide any

future benefits to the executive; provided, however that if Mr. Campisi terminates his employment for

“good reason” (as defined in the New Employment Agreement), he will be entitled to the payments and

benefits described below in “Termination Without Cause.”

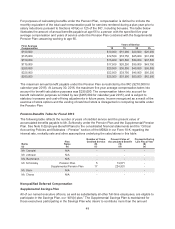

Involuntary Termination Without Cause

If a named executive officer is involuntarily terminated without cause (including a constructive

termination), the Severance Plan would entitle the named executive officer to:

• a cash payment equal to the product of (1) the named executive officer’s annualized base

salary in effect on the date of termination and (2) a multiple thereof;

• a cash payment equal to a prorated portion of the annual incentive award that the named

executive officer would have earned for the fiscal year in which the termination occurred had

such termination not occurred;

• a cash payment for outplacement assistance;

• continued coverage for the named executive officer under our health plans until the last day of

the calendar month in which the post-termination restriction period applicable to the named

executive officer elapses, plus the amount necessary to reimburse the named executive

officer for the taxes he or she would be liable for as a result of such continued coverage; and

• prorated vesting of all unvested, outstanding restricted stock awards granted to the named

executive officer on or before February 1, 2014 and, upon achievement of the applicable

performance trigger, prorated vesting of all unvested, outstanding RSU awards granted to the

named executive officer.

51