Big Lots 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

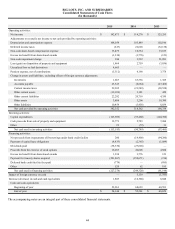

Derivative Instruments

We use derivative instruments to mitigate the risk of market fluctuations in diesel fuel prices. We do not enter into derivative

instruments for speculative purposes. Our derivative instruments may consist of collar or swap contracts. Our current

derivative instruments do not meet the requirements for cash flow hedge accounting. Instead, our derivative instruments are

marked-to-market to determine their fair value and any gains or losses are recognized currently in other income (expense) on

our consolidated statements of operations.

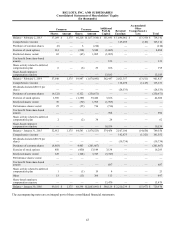

Other Comprehensive Income

Our other comprehensive income includes the impact of the amortization of our pension actuarial loss, net of tax, the

revaluation of our pension actuarial loss, net of tax, and the impact of foreign currency translation.

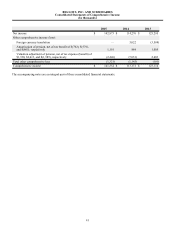

Supplemental Cash Flow Disclosures

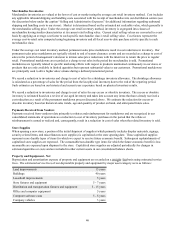

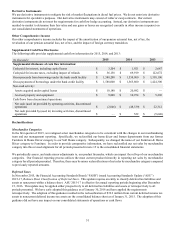

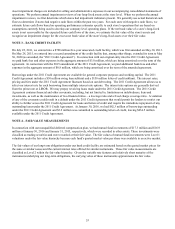

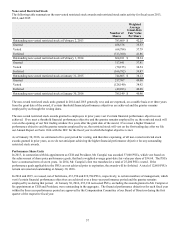

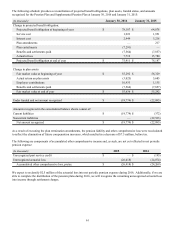

The following table provides supplemental cash flow information for 2015, 2014, and 2013:

(In thousands) 2015 2014 2013

Supplemental disclosure of cash flow information:

Cash paid for interest, including capital leases $ 3,204 $ 1,921 $ 2,687

Cash paid for income taxes, excluding impact of refunds $ 56,158 $ 69,919 $ 122,672

Gross proceeds from borrowings under the bank credit facility $ 1,588,200 $ 1,550,900 $ 1,330,100

Gross payments of borrowings under the bank credit facility $ 1,588,000 $ 1,565,800 $ 1,424,300

Non-cash activity:

Assets acquired under capital leases $ 10,180 $ 20,982 $ —

Accrued property and equipment $ 9,808 $ 10,974 $ 5,296

Cash flows from discontinued operations:

Net cash (used in) provided by operating activities, discontinued

operations $ (2,846)$ (48,339) $ 22,312

Net cash provided by (used in) investing activities, discontinued

operations $ — $ 522 $ (5,640)

Reclassifications

Merchandise Categories

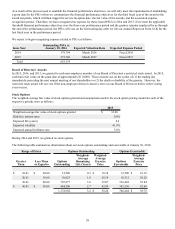

In the first quarter of 2015, we realigned select merchandise categories to be consistent with the changes in our merchandising

team and our management reporting. Specifically, we reclassified our home décor and frames departments from our former

Furniture & Home Décor category to our Soft Home category. Subsequently, we changed the name of our Furniture & Home

Décor category to Furniture. In order to provide comparative information, we have reclassified our net sales by merchandise

category into this revised alignment for all periods presented in note 15 to the consolidated financial statements.

We periodically assess, and make minor adjustments to, our product hierarchy, which can impact the roll-up of our merchandise

categories. Our financial reporting process utilizes the most current product hierarchy in reporting net sales by merchandise

category for all periods presented. Therefore, there may be minor reclassifications of net sales by merchandise category compared

to previously reported amounts.

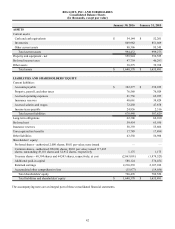

Deferred Taxes

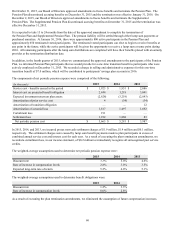

In November 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

2015-17, Balance Sheet Classification of Deferred Taxes. This update requires an entity to classify deferred tax liabilities and

assets as noncurrent within a balance sheet. ASU 2015-17 is effective for annual reporting periods beginning after December

15, 2016. This update may be applied either prospectively to all deferred tax liabilities and assets or retrospectively to all

periods presented. We have early adopted this guidance as of January 30, 2016 and have applied the requirements

retrospectively. The adoption of this guidance resulted in the reclassification of $39.2 million from current deferred income tax

assets to noncurrent deferred income tax assets on the consolidated balance sheet as of January 31, 2015. The adoption of this

guidance did not have any impact on our consolidated statements of operations or cash flows.