Big Lots 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

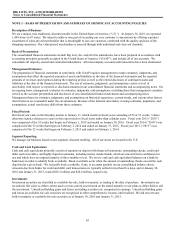

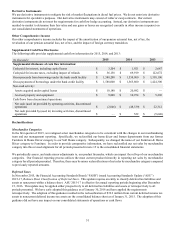

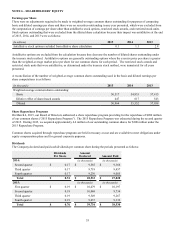

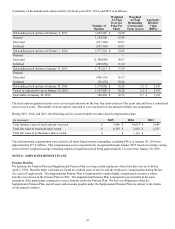

Asset impairment charges are included in selling and administrative expenses in our accompanying consolidated statements of

operations. We perform annual impairment reviews of our long-lived assets at the store level. When we perform the annual

impairment reviews, we first determine which stores had impairment indicators present. We generally use actual historical cash

flows to determine if stores had negative cash flows within the past two years. For each store with negative cash flows, we

estimate future cash flows based on operating performance estimates specific to each store’s operations that are based on

assumptions currently being used to develop our company level operating plans. If the net book value of a store’s long-lived

assets is not recoverable by the expected future cash flows of the store, we estimate the fair value of the store's assets and

recognize an impairment charge for the excess net book value of the store’s long-lived assets over their fair value.

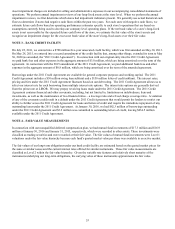

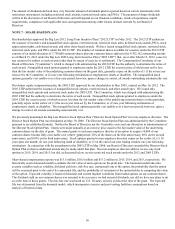

NOTE 3 – BANK CREDIT FACILITY

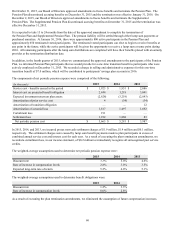

On July 22, 2011, we entered into a $700 million five-year unsecured credit facility, which was first amended on May 30, 2013.

On May 28, 2015, we entered into a second amendment of the credit facility that, among other things, extended its term to May

30, 2020 (as amended, the “2011 Credit Agreement”). In connection with our original entry into the 2011 Credit Agreement,

we paid bank fees and other expenses in the aggregate amount of $3.0 million, which are being amortized over the term of the

agreement. In connection with the 2015 amendment of the 2011 Credit Agreement, we paid additional bank fees and other

expenses in the aggregate amount of $0.8 million, which are being amortized over the term of the amended agreement.

Borrowings under the 2011 Credit Agreement are available for general corporate purposes and working capital. The 2011

Credit Agreement includes a $30 million swing loan sublimit and a $150 million letter of credit sublimit. The interest rates,

pricing and fees under the 2011 Credit Agreement fluctuate based on our debt rating. The 2011 Credit Agreement allows us to

select our interest rate for each borrowing from multiple interest rate options. The interest rate options are generally derived

from the prime rate or LIBOR. We may prepay revolving loans made under the 2011 Credit Agreement. The 2011 Credit

Agreement contains financial and other covenants, including, but not limited to, limitations on indebtedness, liens and

investments, as well as the maintenance of two financial ratios – a leverage ratio and a fixed charge coverage ratio. A violation

of any of the covenants could result in a default under the 2011 Credit Agreement that would permit the lenders to restrict our

ability to further access the 2011 Credit Agreement for loans and letters of credit and require the immediate repayment of any

outstanding loans under the 2011 Credit Agreement. At January 30, 2016, we had $62.3 million of borrowings outstanding

under the 2011 Credit Agreement and $3.2 million was committed to outstanding letters of credit, leaving $634.5 million

available under the 2011 Credit Agreement.

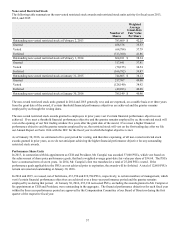

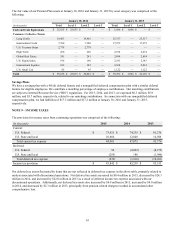

NOTE 4 – FAIR VALUE MEASUREMENTS

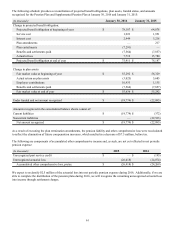

In connection with our nonqualified deferred compensation plan, we had mutual fund investments of $17.3 million and $16.9

million at January 30, 2016 and January 31, 2015, respectively, which were recorded in other assets. These investments were

classified as trading securities and were recorded at their fair value. The fair values of mutual fund investments were Level 1

valuations under the fair value hierarchy because each fund’s quoted market value per share was available in an active market.

The fair values of our long-term obligations under our bank credit facility are estimated based on the quoted market prices for

the same or similar issues and the current interest rates offered for similar instruments. These fair value measurements are

classified as Level 2 within the fair value hierarchy. Given the variable rate features and relatively short maturity of the

instruments underlying our long-term obligations, the carrying value of these instruments approximates the fair value.