Big Lots 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

The fair values of our derivative instruments are determined using observable inputs from commonly quoted markets. These

fair value measurements are classified as Level 2 within the fair value hierarchy.

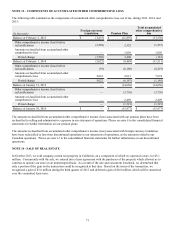

NOTE 12 – DISCONTINUED OPERATIONS

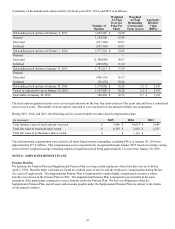

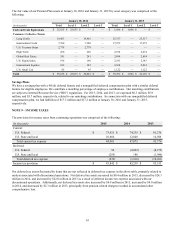

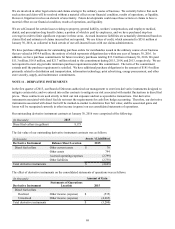

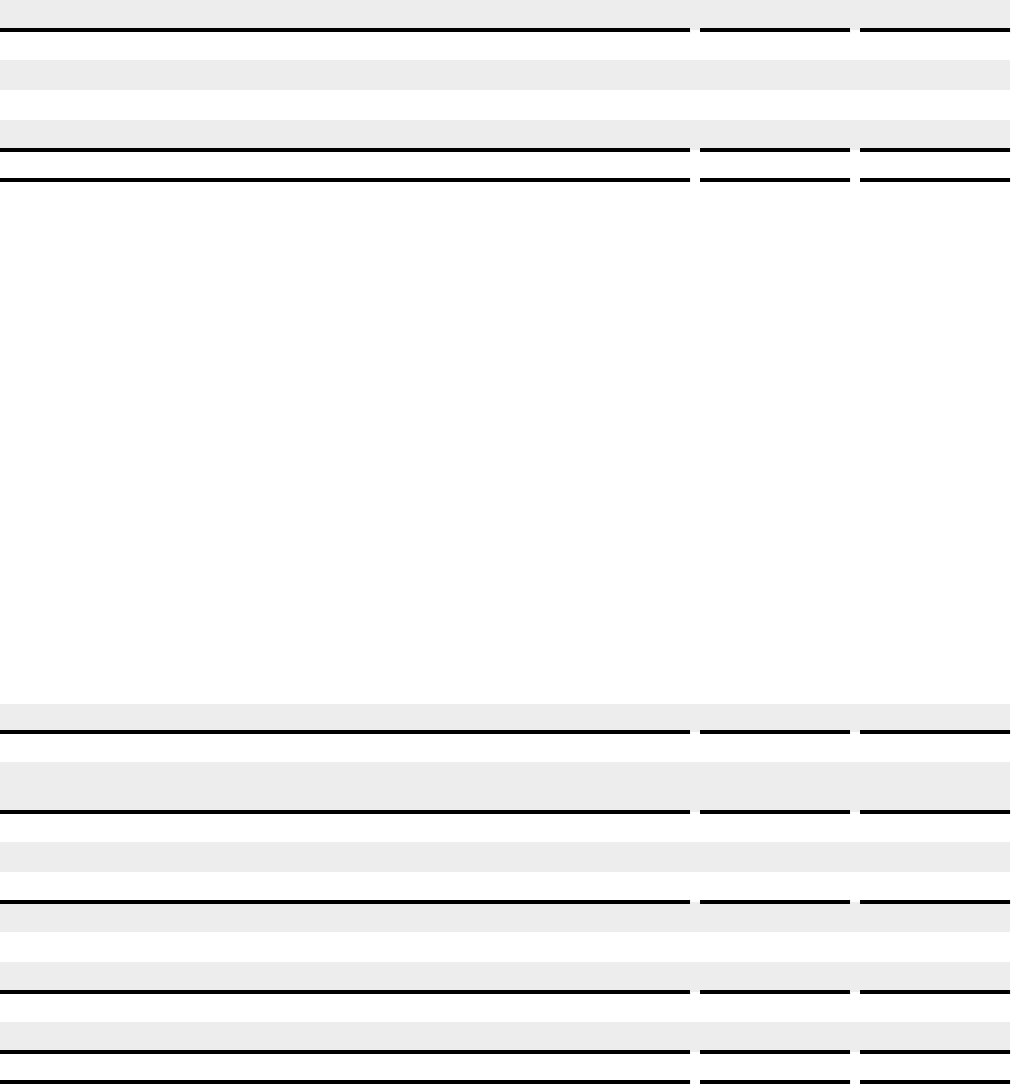

Our discontinued operations for 2015, 2014, and 2013, were comprised of the following:

(In thousands) 2015 2014 2013

Canadian operations $ 165 $ (35,998)$ (40,918)

Wholesale business (164)(248)(4,371)

KB Toys matters — 9 5,248

Other (1)— —

Total loss from discontinued operations, pretax $ — $ (36,237)$ (40,041)

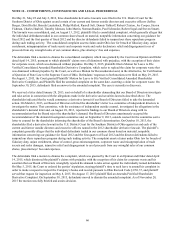

Canadian Operations

During the fourth quarter of 2013, we announced our intention to wind down our Canadian operations. We began the wind

down activities during the fourth quarter of 2013, which included the closing of our Canadian distribution centers. We

completed the wind down activities during the first quarter of 2014, which included the closure of our Canadian stores and

corporate offices. Therefore, we determined the results of our Canadian operations should be reported as discontinued

operations. The results of our Canadian operations historically consisted of sales of product to retail customers, the costs

associated with those products, and selling and administrative expenses, including personnel, purchasing, warehousing,

distribution, occupancy and overhead costs. In the first quarter of 2014, the results of our Canadian operations also included

significant contract termination costs of $23.0 million, severance charges of $2.2 million and a loss on the realization of our

cumulative translation adjustment on our investment in our Canadian operations of $5.1 million.

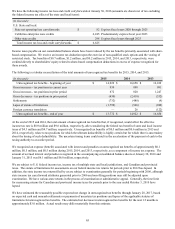

In addition to the costs associated with our Canadian operations, we reclassified to discontinued operations the direct expenses

incurred by our U.S. operations to facilitate the wind down. These costs primarily consist of professional fees. We also

reclassified the income tax benefit that our U.S. operations was expected to, and did, generate as a result of the wind down of

our Canadian operations, based principally on our ability to recover a worthless stock deduction in the foreseeable future.

During 2015, 2014, and 2013, the amount of this income tax expense (benefit) that we recognized was approximately $0.2

million, $(13.8) million, and $(24.4) million, respectively.

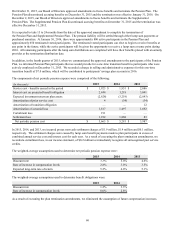

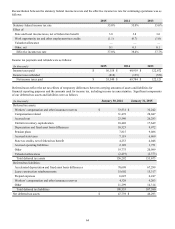

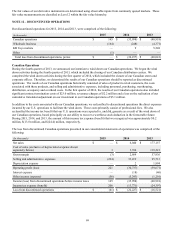

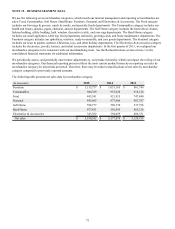

The loss from discontinued Canadian operations presented in our consolidated statements of operations was comprised of the

following:

(In thousands) 2015 2014 2013

Net sales $ — $ 6,040 $ 177,157

Cost of sales (exclusive of depreciation expense shown

separately below) 3 3,356 119,221

Gross margin (3) 2,684 57,936

Selling and administrative expenses (224) 33,419 95,713

Depreciation expense — 2 1,894

Operating profit (loss) 221 (30,737)(39,671)

Interest expense — (18)(46)

Other income (expense) (56)(5,243)(1,201)

Income (loss) from discontinued operations before income taxes 165 (35,998)(40,918)

Income tax expense (benefit) 206 (13,771)(24,397)

Loss from discontinued operations $ (41)$ (22,227)$ (16,521)