Big Lots 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• an increase of $13.5 million in net sales;

• Adjusted income from continuing operations of $2.971in diluted earnings per share, compared

to income from continuing operations of $2.46 in diluted earnings per share in fiscal 2014, a

21% increase;

• an increase of 30 basis points in gross margin rate;

• return on invested capital (i.e., net operating profit after-tax divided by invested capital)

(“ROIC”) of 16.6%;

• an increase in operating profit of $11.2 million, or 5%; and

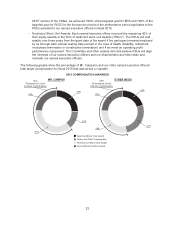

• $200 million returned to shareholders through share repurchases and approximately $39

million returned to shareholders through dividends.

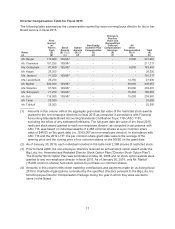

Named Executive Officer Compensation for Fiscal 2015

The principal elements of our executive compensation program – salary, annual cash incentive awards

and equity awards – remained the same in fiscal 2015. The Committee and our other outside directors

are committed to a pay-for-performance philosophy focused on the continued improvement of our

financial and operating performance and believe that emphasizing at-risk and variable compensation

advances the objectives of our executive compensation program. Accordingly, the Committee and our

other outside directors structured a significant portion of the compensation awarded to our named

executive officers for fiscal 2015 as “at risk” or “variable” and dependent on our performance and/or the

value of our common shares, including:

•Annual Cash Incentive Awards. Each named executive officer was eligible to receive a cash

performance bonus based solely on our operating profit. The fiscal 2015 annual incentive

awards were structured so that the target bonus would be earned only if we achieved the

operating profit for fiscal 2015 projected in our annual corporate operating plan. The

Committee and our other outside directors selected operating profit as the sole financial

measure because they believe it focuses our named executive officers on increasing our

revenues and controlling our costs. Based on our $235,731,648 operating profit in fiscal 2015,

as adjusted and described below in the “Elements of our Executive Compensation for Fiscal

2015 – Annual Incentive Award for Fiscal 2015” section of the CD&A, our named executive

officers earned an annual incentive award for fiscal 2015 equal to 166% of their respective

target bonus.

•Performance Share Unit Awards. Each named executive officer received 60% of their equity

awards in the form of performance share unit awards (“PSUs”). The PSUs awarded to our

named executive officers in fiscal 2015 will vest, if at all, after the completion of a three-year

performance period based: (1) 50% on our average EPS performance, excluding plan-defined

items, for each of the three fiscal year service periods during the performance period; (2) 50%

on our average ROIC performance, excluding plan-defined items, for each of the three fiscal

year service periods during the performance period; and (3) on the named executive officer’s

continued employment through the end of the performance period (except in the case of

death, disability or retirement). The Committee and our other outside directors selected EPS

and ROIC as the financial measures applicable to the PSUs to incentivize our named

executive officers to achieve long-term financial results that they believe will create

shareholder value. Based on EPS of $2.81 and ROIC of 16.6%, as adjusted and described

below in the “Elements of our Executive Compensation for Fiscal 2015 – Equity for Fiscal

1Adjusted to exclude an after-tax impact of $0.11 associated with pension termination costs and

$0.05 for a loss contingency associated with a merchandise related legal matter.

21