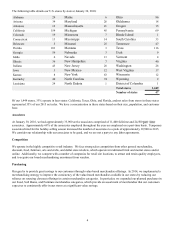

Big Lots 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Seasonality

We have historically experienced, and expect to continue to experience, seasonal fluctuations in our sales and profitability, with

a larger percentage of our net sales and operating profit realized in our fourth fiscal quarter. In addition, our quarterly net sales

and operating profits can be affected by the timing of new store openings and store closings, the timing of advertising, and the

timing of certain holidays. We historically receive a higher proportion of merchandise, carry higher inventory levels, and incur

higher outbound shipping and payroll expenses as a percentage of sales in our third fiscal quarter in anticipation of increased

sales activity during our fourth fiscal quarter. Performance during our fourth fiscal quarter typically reflects a leveraging effect

which has a favorable impact on our operating results because net sales are higher and certain of our costs, such as rent and

depreciation, are fixed and do not vary as sales levels escalate. For a quantitative view of this leveraging effect, see

“Seasonality” in the accompanying MD&A in this Form 10-K.

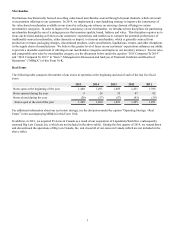

The seasonality of our net sales and related merchandise inventory requirements influences the availability of and demand for

cash or access to credit. We historically have drawn upon our credit facility to assist in funding our working capital

requirements, which typically peak near the end of our third fiscal quarter. We historically have higher net sales, operating

profits, and cash flow provided by operations in the fourth fiscal quarter which allows us to substantially repay our seasonal

borrowings. In 2015, our total indebtedness (outstanding borrowings and letters of credit) peaked in November 2015 at

approximately $383 million under our $700 million unsecured credit facility entered into in July 2011, and most recently

amended in May 2015 (“2011 Credit Agreement”). The 2011 Credit Agreement expires in May 2020. At January 30, 2016, our

total indebtedness under the 2011 Credit Agreement was $65.5 million, which included $62.3 million in borrowings and $3.2

million in outstanding letters of credit. We expect that borrowings will vary throughout 2016 depending on various factors,

including our seasonal need to acquire merchandise inventory prior to the peak selling season, the timing and amount of sales

to our customers, and the timing of share repurchase or dividend payment activity. For a discussion of our sources and uses of

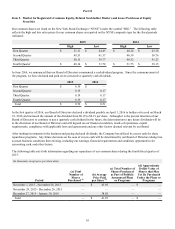

funds, see “Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities” and “Capital Resources and Liquidity” in the accompanying MD&A, in this Form 10-K.

Available Information

We make available, free of charge, through the “Investor Relations” section of our website (www.biglots.com) under the “SEC

Filings” caption, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and

amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as

amended (“Exchange Act”), as soon as reasonably practicable after we file such material with, or furnish it to, the Securities

and Exchange Commission (“SEC”). Our filings with the SEC may be read and copied at the SEC’s Public Reference Room at

100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by

calling 1-800-SEC-0330. These filings are also available on the SEC’s website at http://www.sec.gov free of charge as soon as

reasonably practicable after we have filed the above referenced reports.

In the “Investor Relations” section of our website (www.biglots.com) under the “Corporate Governance” and “SEC Filings”

captions, the following information relating to our corporate governance may be found: Corporate Governance Guidelines;

charters of our Board of Directors’ Audit, Compensation, Nominating/Corporate Governance Committees, and our Public

Policy and Environmental Affairs Committee; Code of Business Conduct and Ethics; Code of Ethics for Financial Officers;

Chief Executive Officer and Chief Financial Officer certifications related to our SEC filings; the means by which shareholders

may communicate with our Board of Directors; and transactions in our securities by our directors and executive officers. The

Code of Business Conduct and Ethics applies to all of our associates, including our directors and our principal executive

officer, principal financial officer, and principal accounting officer. The Code of Ethics for Financial Professionals applies to

our Chief Executive Officer and all other Senior Financial Officers (as that term is defined therein) and contains provisions

specifically applicable to the individuals serving in those positions. We intend to satisfy the requirement under Item 5.05 of

Form 8-K regarding disclosure of amendments to and waivers from, if any, our Code of Business Conduct and Ethics (to the

extent applicable to our directors and executive officers (including our principal executive officer, principal financial officer

and principal accounting officer)) and our Code of Ethics for Financial Professionals in the “Investor Relations” section of our

website (www.biglots.com) under the “Corporate Governance” caption. We will provide any of the foregoing information

without charge upon written request to our Corporate Secretary. The contents of our website are not incorporated into, or

otherwise made a part of, this Form 10-K.