Big Lots 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

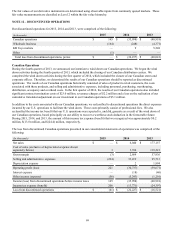

Wholesale Business

During the third quarter of 2013, we announced our intention to wind down the operations of our wholesale business. During

the fourth quarter of 2013, we executed our wind down plan and ceased the operations of our wholesale business; therefore, we

determined the results of our wholesale business should be reported as discontinued operations. The results of operations of

our wholesale business primarily consisted of sales of product to wholesale customers, the costs associated with those products,

and selling and administrative expenses, including personnel, purchasing, warehousing, distribution, occupancy and overhead

costs.

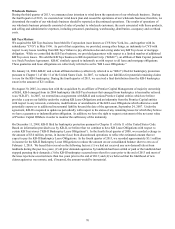

KB Toys Matters

We acquired the KB Toys business from Melville Corporation (now known as CVS New York, Inc., and together with its

subsidiaries “CVS”) in May 1996. As part of that acquisition, we provided, among other things, an indemnity to CVS with

respect to any losses resulting from KB Toys' failure to pay all monies due and owing under any KB Toys lease or mortgage

obligation. While we controlled the KB Toys business, we provided guarantees with respect to a limited number of additional

KB Toys store leases. We sold the KB Toys business to KB Acquisition Corp. (“KBAC”), an affiliate of Bain Capital, pursuant

to a Stock Purchase Agreement. KBAC similarly agreed to indemnify us with respect to all lease and mortgage obligations.

These guarantee and lease obligations are collectively referred to as the “KB Lease Obligations.”

On January 14, 2004, KBAC and certain affiliated entities (collectively referred to as “KB-I”) filed for bankruptcy protection

pursuant to Chapter 11 of title 11 of the United States Code. In 2007, we reduced our liabilities for potential remaining claims

to zero for the KB-I bankruptcy. During the fourth quarter of 2013, we received a final distribution from the KB-I bankruptcy

estate in the amount of $2.1 million.

On August 30, 2005, in connection with the acquisition by an affiliate of Prentice Capital Management of majority ownership

of KB-I, KB-I emerged from its 2004 bankruptcy (the KB Toys business that emerged from bankruptcy is hereinafter referred

to as “KB-II”). In 2007, we entered into an agreement with KB-II and various Prentice Capital entities which we believe

provides a cap on our liability under the existing KB Lease Obligations and an indemnity from the Prentice Capital entities

with respect to any renewals, extensions, modifications or amendments of the KB Lease Obligations which otherwise could

potentially expose us to additional incremental liability beyond the date of the agreement, September 24, 2007. Under the

agreement, KB-II is required to update us periodically with respect to the status of any remaining leases for which they believe

we have a guarantee or indemnification obligation. In addition, we have the right to request a statement of the net asset value

of Prentice Capital Offshore in order to monitor the sufficiency of the indemnity.

On December 11, 2008, KB-II filed for bankruptcy protection pursuant to Chapter 11 of title 11 of the United States Code.

Based on information provided to us by KB-II, we believe that we continue to have KB Lease Obligations with respect to

certain KB Toys stores (“KB-II Bankruptcy Lease Obligations”). In the fourth fiscal quarter of 2008, we recorded a charge in

the amount of $5.0 million, pretax, in income (loss) from discontinued operations to reflect the estimated amount that we

expect to pay for KB-II Bankruptcy Lease Obligations. In the fourth quarter of 2013, we recorded approximately $3.1 million

in income for the KB-II Bankruptcy Lease Obligations to reduce the amount on our consolidated balance sheet to zero as of

February 1, 2014. We based this reversal on the following factors: (1) we had not received any new demand letters from

landlords during the past two years; (2) all prior demands against us by landlords had been settled or paid or the landlords had

stopped pursuing their demands; (3) the KB-II bankruptcy occurred more than five years prior to the end of 2013 and most of

the lease rejections occurred more than two years prior to the end of 2013; and (4) we believed that the likelihood of new

claims against us was remote, and, if incurred, the amount would be immaterial.