Big Lots 2015 Annual Report Download - page 42

Download and view the complete annual report

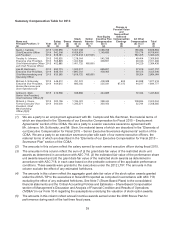

Please find page 42 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additionally, in connection with their promotions in August 2015, the Committee approved an additional

annual incentive award under the 2006 Bonus Plan for Mr. Johnson, Ms. Bachmann and Mr. Schlonsky

based on our operating profit during the third and fourth quarters of fiscal 2015. As a result of our

operating profit performance during the third and fourth quarters of fiscal 2015, Mr. Johnson received

an additional bonus of $12,551, Ms. Bachmann received an additional bonus of $15,413 and

Mr. Schlonsky received an additional bonus of $47,474.

Our operating profit for fiscal 2015 exceeded the expectations of the Board, the Committee and

management and earned a bonus between the target and maximum performance levels. As a

consequence of the fiscal 2015 bonus payments, total cash compensation paid to the named executive

officers for fiscal 2015 was generally at or above the median for our peer group. We believe higher

than market average total cash compensation is appropriate in light of our fiscal 2015 performance and

advances our objectives to motivate our executives and reward strong performance.

Equity for Fiscal 2015

All equity awards granted to our named executive officers since May 23, 2012 have been issued under

the 2012 LTIP. For fiscal 2015, we awarded PSUs and RSUs to our named executive officers. The

Committee believes that granting a competitive amount of equity to our named executive officers aligns

their interests with the interests of our shareholders and helps retain and motivate them. The

Committee uses its discretion and market data to determine grant equity award sizes and does not

utilize a particular formula to determine the size of the equity awards it grants. The Committee

undertook the following process to determine the size of the equity awards granted to our named

executive officers for fiscal 2015:

• The Committee reviewed an estimate prepared by management of the number of common

shares underlying the equity awards granted during fiscal 2015 to all recipients other than

Mr. Campisi. This estimate was based on historical grant information, anticipated future

events, and Mr. Campisi’s evaluation of the other Leadership Team members’ individual

performance and his recommendations for the size of their equity awards.

• In executive session, the Committee evaluated and approved Mr. Campisi’s

recommendations for equity awards for the other Leadership Team members and determined

the equity award for our CEO. In each case, the Committee made these determinations based

on historical grant information and the Committee’s subjective views of comparative

compensation data, retention factors, corporate performance (particularly operating profit,

income from continuing operations, selling and administrative expenses and EPS against

planned and prior performance), individual performance, the executive’s level of responsibility,

the potential impact that the executive could have on our operations and financial condition

and the market price of our common shares. See the “Performance Evaluation” section of this

CD&A for a discussion regarding how our CEO and the Committee evaluate performance.

The Committee believes that this process makes our equity compensation awards consistent with

corporate and individual performance and our policy that incentive compensation should increase as a

percentage of total compensation as the executive’s level of responsibility and potential impact on our

operations and financial condition increases. Corporate and individual performance were the most

significant factors in determining the size of the equity awards made to our named executive officers in

fiscal 2015.

Vested PSUs and RSUs will be settled in our common shares. Any PSUs or RSUs that do not vest will

be forfeited. The PSUs and RSUs do not have voting rights. PSUs and RSUs include a dividend-

equivalent right, which represents the right to receive the equivalent of any cash dividends payable

with respect to our common shares underlying the awards. Any cash dividends will accrue without

interest and will vest and be paid only at the time the corresponding PSUs or RSUs vest. Any accrued

cash dividends relating to PSUs or RSUs that do not vest will be forfeited.

30