Big Lots 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

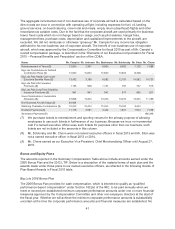

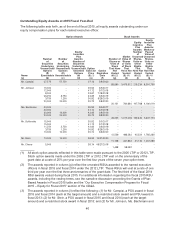

Mr. Schlonsky, a PSU award in fiscal 2015 and fiscal 2014 (each at the target amount) and

restricted stock awards in fiscal 2013, fiscal 2012, and fiscal 2011.

All awards were made pursuant to the 2005 LTIP or 2012 LTIP. The first trigger for the fiscal

2013, fiscal 2012 and fiscal 2011 restricted stock awards is EPS of $1.50 and the second trigger

for the fiscal 2013 award is EPS of $3.98, the second trigger for the fiscal 2012 restricted stock

awards is EPS of $3.95 and the second trigger for the fiscal 2011 restricted stock awards is EPS

of $3.52. The fiscal 2011 restricted stock awards vested on March 8, 2016. The PSU award to

Mr. Campisi in fiscal 2013 vests in one-third increments if the market price of our common shares

appreciates, for a period of 20 consecutive trading days, to prices that are 110%, 120% and

130% of the grant date market value of $37.13 The first two tranches of Mr. Campisi’s 2013 PSU

award vested in fiscal 2014. The actual number of PSUs awarded to each named executive

officer in fiscal 2014 and fiscal 2015 that will vest and be earned (if any) by each named

executive officer is determined after the three-year performance period based: (1) 50% on our

average EPS performance, excluding plan-defined items, for each of the three service periods

during the performance period; (2) 50% on our average ROIC performance (net operating profit

after-tax divided by invested capital for the fiscal year), excluding plan-defined items, for each of

the three service periods during the performance period; and (3) on the named executive officer’s

continued employment through the end of the performance period (except in the case of death,

disability or retirement). For additional information regarding the fiscal 2015 PSU awards,

including the vesting terms, see the narrative discussion preceding the Grants of Plan-Based

Awards in Fiscal 2015 table and the “Our Executive Compensation Program for Fiscal 2015 –

Equity for Fiscal 2015” section of the CD&A.

(4) The market value was computed by multiplying the number of units or shares by $38.78, the

closing price of our common shares on January 30, 2016.

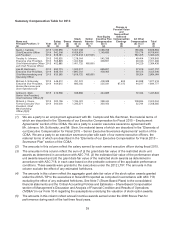

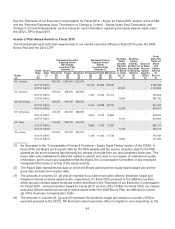

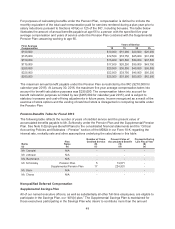

Option Exercises and Stock Vested in Fiscal 2015

The following table reflects all stock option exercises and the vesting of restricted stock held by each of

our named executive officers during fiscal 2015.

Option Awards Stock Awards

Name

Number of Shares

Acquired on Exercise

(#)

Value Realized

on Exercise

($)

Number of Shares

Acquired on Vesting

(#)

Value Realized

on Vesting

($)

(a) (b) (c) (d) (e)

Mr. Campisi 30,475 401,711 22,973 1,147,501

Mr. Johnson 1,875 40,350 5,061 252,797

Ms. Bachmann 36,563 1,180,348 6,730 336,164

Mr. Schlonsky - - 3,140 156,843

Mr. Stein - - 2,948 147,253

Mr. Chene - - 10,536 503,043

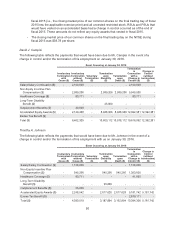

Pension Benefits

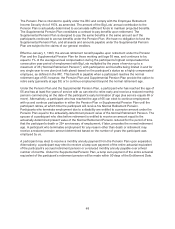

Pension Plan and Supplemental Pension Plan

The Pension Plan is maintained only for certain employees hired before April 1, 1994. Effective

January 1, 1996, the benefits accrued under the Pension Plan for certain highly compensated

individuals were frozen at the then current levels. The Supplemental Pension Plan is maintained only

for those executives whose benefits were frozen under the Pension Plan on or after January 1, 1996.

On December 31, 2015, we froze the accrual of benefits under the Pension Plan and terminated the

Supplemental Pension Plan, and we terminated the Pension Plan on January 31, 2016. Based on their

respective dates of hire, Mr. Schlonsky is the only named executive officer eligible to participate in

these plans.

47