Big Lots 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Retirement Plans

We maintain four retirement plans: (1) a tax-qualified defined contribution plan (“Savings Plan”); (2) a

non-qualified supplemental defined contribution plan (“Supplemental Savings Plan”); (3) a tax-qualified,

funded noncontributory defined benefit pension plan (“Pension Plan”); and (4) a non-qualified,

unfunded supplemental defined benefit pension plan (“Supplemental Pension Plan”). We believe that

the Savings Plan and Supplemental Savings Plan are generally commensurate with the retirement

plans provided by companies in our comparator groups and that providing these plans enhances our

ability to attract and retain qualified executives. Participation in the Pension Plan and Supplemental

Pension Plan, which we do not believe are material elements of our executive compensation program,

is limited to certain employees whose hire date precedes April 1, 1994. On December 31, 2015, we

froze the accrual of benefits under the Pension Plan and terminated the Supplemental Pension Plan,

and we terminated the Pension Plan on January 31, 2016. Mr. Schlonsky is the only named executive

officer eligible to participate in the Pension Plan or Supplemental Pension Plan. See the “Pension

Benefits – Pension Plan and Supplemental Pension Plan” section of this Proxy Statement for a

discussion of our retirement plans.

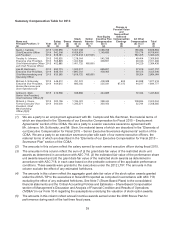

Our Executive Compensation Program for Fiscal 2016

In establishing the executive compensation program for fiscal 2016, the Committee engaged Exequity

to:

• provide comparative compensation data;

• review and recommend changes to our executive compensation program;

• review the appropriateness of our retailer-only comparator group; and

• compare the amount and form of executive compensation paid to our executives against the

compensation paid to similarly-situated executives at companies within the retailer-only

comparator group.

The Committee did not make any material changes to the design of our executive compensation

program when establishing compensation for fiscal 2016. For fiscal 2016, we awarded RSUs and

PSUs. The RSUs vest ratably over three years from the grant date of the award and also contain a

performance component intended to preserve deductibility under Section 162(m) of the IRC. The PSUs

vest only if we meet performance targets over a three-year performance period. For the fiscal 2016

service period, the PSU performance targets are based on EPS and ROIC, each of which account for

50% of the performance component of the PSUs.

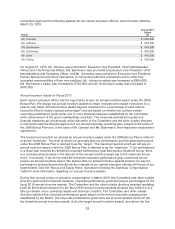

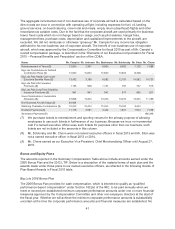

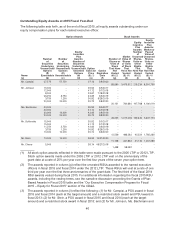

For fiscal 2016, the Committee recommended, and the outside directors approved, the following

salaries, payout percentages for the target annual incentive award level (with threshold being one-half

of the target payout percentage and maximum being double the target payout percentage) and equity

awards for our named executive officers:

Name

Fiscal 2016

Salary

($)

Fiscal 2016

Target Annual

Incentive Award

Payout Percentage

(%)

Common Shares

Underlying

RSU Award

(#)

Common Shares

Underlying

Target PSU Award

(#)

Mr. Campisi 1,100,000 120 54,735 82,104

Mr. Johnson 580,920 60 13,619 20,430

Ms. Bachmann 741,600 60 17,386 26,080

Mr. Schlonsky 484,100 60 11,349 17,025

Mr. Stein 428,480 50 6,697 10,046

36