Big Lots 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Merchandise

Our business has historically focused on selling value-based merchandise sourced through closeout channels, which can result

in inconsistent offerings to our customers. In 2014, we implemented a merchandising strategy to improve the consistency of

the value-based merchandise available in our stores by reducing our reliance on sourcing closeout offerings in certain

merchandise categories. In order to improve the consistency of our merchandise, we introduced new disciplines for purchasing

merchandise through the use of a ratings process that measures quality, brand, fashion, and value. This discipline requires us to

focus our decision-making activities on our customers’ expectations and enables us to compare the potential performance of

traditionally-sourced merchandise, either domestic or import, to closeout merchandise, which is generally sourced from

production overruns, packaging changes, discontinued products, order cancellations, liquidations, returns, and other disruptions

in the supply chain of manufacturers. We believe this greater level of focus on our customers’ expectations enhances our ability

to provide a desirable assortment of offerings in our merchandise categories and improves our inventory turnover. For net sales

and comparable store sales by merchandise category, see the discussion below under the captions “2015 Compared To 2014”

and “2014 Compared To 2013” in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations” (“MD&A”) of this Form 10-K.

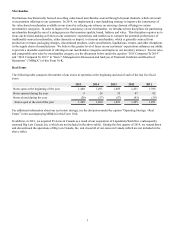

Real Estate

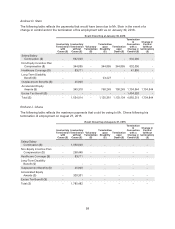

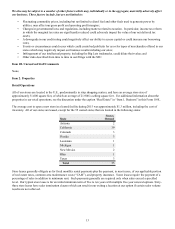

The following table compares the number of our stores in operation at the beginning and end of each of the last five fiscal

years:

2015 2014 2013 2012 2011

Stores open at the beginning of the year 1,460 1,493 1,495 1,451 1,398

Stores opened during the year 9 24 55 87 92

Stores closed during the year (20) (57)(57)(43)(39)

Stores open at the end of the year 1,449 1,460 1,493 1,495 1,451

For additional information about our real estate strategy, see the discussion under the caption “Operating Strategy - Real

Estate” in the accompanying MD&A in this Form 10-K.

In addition, in 2011, we acquired 89 stores in Canada as a result of our acquisition of Liquidation World Inc. (subsequently

renamed Big Lots Canada, Inc.) (which are not included in the above table). During the first quarter of 2014, we wound down

and discontinued the operations of Big Lots Canada, Inc. and closed all of our stores in Canada (which are not included in the

above table).