Big Lots 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

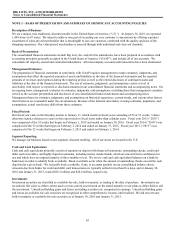

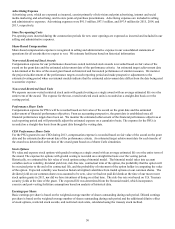

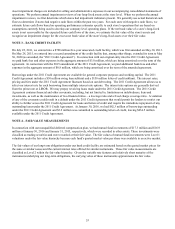

Recent Accounting Standards

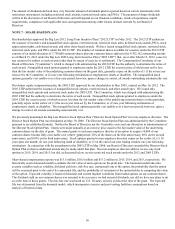

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). This update provides a

comprehensive new revenue recognition model that requires a company to recognize revenue to depict the transfer of goods or

services to a customer at an amount that reflects the consideration it expects to receive in exchange for those goods or services.

Additionally, this guidance expands related disclosure requirements. The pronouncement was originally set to be effective for

annual and interim reporting periods beginning after December 15, 2016. In July 2015, the FASB approved a one-year deferral

of the effective date from December 15, 2016 to December 15, 2017, but will allow for early adoption as of December 15,

2016. This ASU permits the use of either the retrospective or cumulative effect transition method. We are currently evaluating

the impact this guidance will have on our consolidated financial statements as well as the expected adoption method.

In February 2016, the FASB issued ASU 2016-02, Leases. The update requires a lessee to recognize a liability to make lease

payments and a right-of-use asset representing a right to use the underlying asset for the lease term on the balance sheet. The

ASU is effective for fiscal years, and interim periods within those years, beginning after December 15, 2018, with early

adoption permitted. We are currently evaluating the impact that this standard will have on our consolidated financial

statements.

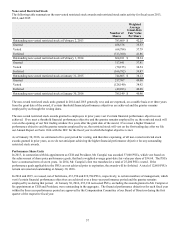

Subsequent Events

We have evaluated events and transactions subsequent to the balance sheet date. Based on this evaluation, we are not aware of

any events or transactions (other than those disclosed in notes 10 and 17) that occurred subsequent to the balance sheet date but

prior to filing that would require recognition or disclosure in our consolidated financial statements.

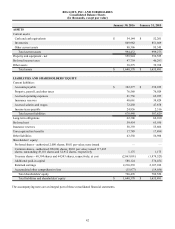

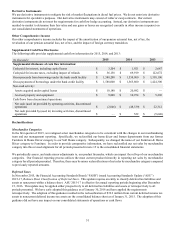

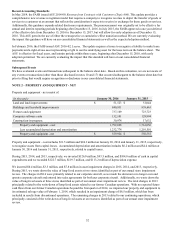

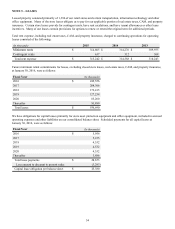

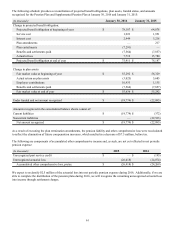

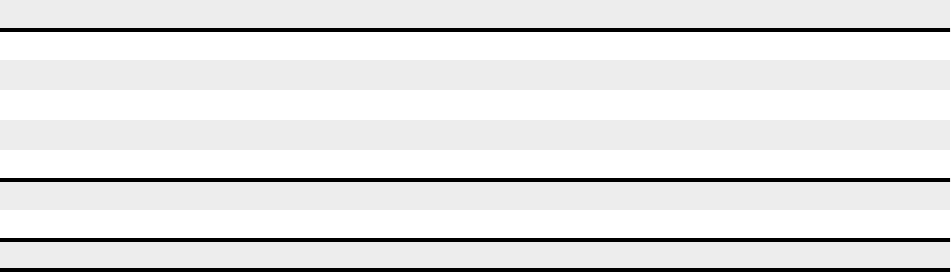

NOTE 2 – PROPERTY AND EQUIPMENT - NET

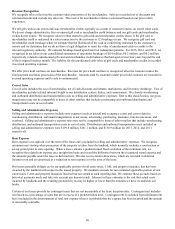

Property and equipment - net consist of:

(In thousands) January 30, 2016 January 31, 2015

Land and land improvements $ 51,523 $ 51,044

Buildings and leasehold improvements 840,931 838,663

Fixtures and equipment 737,169 723,723

Computer software costs 132,101 129,994

Construction-in-progress 30,974 17,632

Property and equipment - cost 1,792,698 1,761,056

Less accumulated depreciation and amortization 1,232,774 1,210,501

Property and equipment - net $ 559,924 $ 550,555

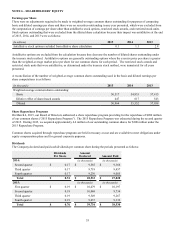

Property and equipment - cost includes $31.5 million and $24.3 million at January 30, 2016 and January 31, 2015, respectively,

to recognize assets from capital leases. Accumulated depreciation and amortization includes $6.2 million and $4.4 million at

January 30, 2016 and January 31, 2015, respectively, related to capital leases.

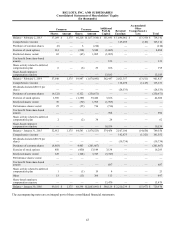

During 2015, 2014, and 2013, respectively, we invested $126.0 million, $93.5 million, and $104.8 million of cash in capital

expenditures and we recorded $122.7 million, $119.7 million, and $113.2 million of depreciation expense.

We incurred $0.4 million, $3.5 million, and $7.8 million in asset impairment charges in 2015, 2014, and 2013, respectively.

During 2015, we wrote down the value of long-lived assets at two stores identified as part of our annual store impairment

review. The charges in 2014 were primarily related to our corporate aircraft, as we made the decision to no longer own and

operate corporate aircraft and entered into sales agreements for both our corporate aircraft. Additionally, we wrote down the

value of long-lived assets at three stores identified as part of our annual store impairment review. The total charges in 2013

principally related to the write-down of long-lived assets related to our former Canadian operations. With no expected future

cash flows from our former Canadian operations beyond the first quarter of 2014, we impaired our property and equipment to

its estimated salvage value at February 1, 2014, which resulted in an impairment charge of $6.5 million, which has been

included in results from discontinued operations. The remaining charges in 2013 related to our continuing operations, which

principally consisted of the write-down of long-lived assets at seven stores identified as part of our annual store impairment

review.