Big Lots 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

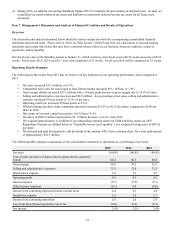

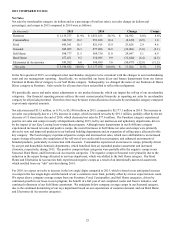

Selling and Administrative Expenses

Selling and administrative expenses were $1,699.8 million in 2014, compared to $1,664.0 million in 2013. The increase of

$35.8 million, or 2.2%, was primarily due to increases in accrued bonus expense of $26.2 million, self-insurance costs of $8.6

million, store occupancy expenses of $5.2 million, corporate office payroll expenses of $2.6 million, and store utilities expense

of $2.3 million, and the absence of a gain on the sale of real estate of $3.6 million. These increases were partially offset by a

decrease in store related payroll of $6.1 million, the absence of a non-recurring litigation settlement of $4.4 million, and a

decrease in share-based compensation expense of $2.7 million. The increase in accrued bonus expense was directly related to

better financial performance in 2014 relative to our annual operating plan as compared to our performance during 2013. The

increase in self-insurance costs was due to an unfavorable development for our self-insurance programs, particularly our

general liability coverage, during the fourth quarter of 2014. The increase in store occupancy expense was primarily the result

of an increase in store rents from the exercise of lease options and property maintenance costs. The increase in corporate office

payroll costs was driven by our investment in our merchandising team and expansion of our marketing team as we develop our

omnichannel strategy. The increase in utilities expense was primarily attributable to the unseasonably cold weather in many

regions of the U.S. during the first quarter of 2014, and the roll-out of our cooler and freezer program, which has gradually

increased our energy consumption. The gain on sale of real estate resulted from our sale of an owned store location in the third

quarter of 2013, which did not recur in 2014. The decrease in store related payroll resulted from a net decrease of 33 stores

compared to 2013. The non-recurring litigation settlement was the result of a loss contingency for a legal matter that was

recognized in the first quarter of 2013 and finalized in the second quarter of 2013. The decrease in share-based compensation

expense was primarily driven by the forfeiture of awards by individuals affected by separation activities and the associated

reversal of costs, and the change in the types of equity instruments awarded in 2014 compared to 2013 (specifically the

replacement of stock options with performance share units which have a different expense recognition pattern).

As a percentage of net sales, selling and administrative expenses increased by 30 basis points to 32.8% in 2014 compared to

32.5% in 2013. The primary driver of the 30 basis point increase was the increase of accrued bonus expense which accounted

for a 50 basis point increase partially offset by a 20 basis point leverage in selling and administrative expenses caused by the

increase in net sales. Our future selling and administrative expense as a percentage of net sales rate is dependent upon many

factors including our level of net sales, our ability to implement additional efficiencies, principally in our store and distribution

center operations, and fluctuating commodity prices, such as diesel fuel, which directly affects our outbound transportation

cost.

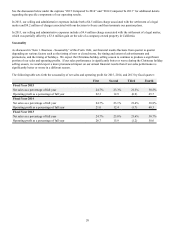

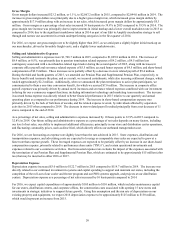

Depreciation Expense

Depreciation expense increased $6.5 million to $119.7 million in 2014 compared to $113.2 million in 2013. The increase was

directly related to capital expenditures in both 2013 and 2014 associated with the implementation of our cooler and freezer

program, store projects, and maintenance of existing stores and distribution centers. Depreciation expense as a percentage of

net sales increased by 10 basis points compared to 2013.

Operating Profit

Operating profit was $224.5 million in 2014 as compared to $230.1 million in 2013. The decrease in operating profit was

primarily driven by the items discussed in the "Net Sales", "Gross Margin", "Selling and Administrative Expenses", and

"Depreciation Expense" sections above. In summary, the increase in our net sales and gross margin was slightly more than

offset by increases in selling and administrative expenses and depreciation expense.

Interest Expense

Interest expense decreased $0.7 million to $2.6 million in 2014 compared to $3.3 million in 2013. The decrease in interest

expense was primarily driven by decreased borrowings in 2014. We had total average borrowings (including capital leases) of

$105.5 million in 2014 compared to total average borrowings of $158.7 million in 2013. The decrease in total average

borrowings was primarily the result of utilizing the excess of our cash inflows from operations, which exceeded cash outflows

from investing activities, to repay portions of our indebtedness.

Income Taxes

The effective income tax rate in 2014 and 2013 for income from continuing operations was 38.4% and 37.7%, respectively.

The increase in our effective rate was principally driven by the recognition of fewer employment-related tax credits in 2014 due

to the late 2014 one-year, retroactive renewal of federal hiring credits and the decline in generation of California employment-

related credits due to the termination of the program, coupled with fewer discrete settlement benefits compared to 2013.