Big Lots 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

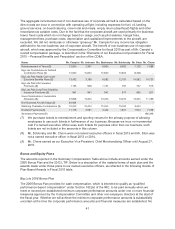

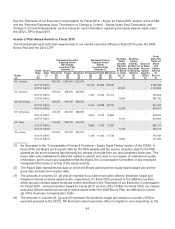

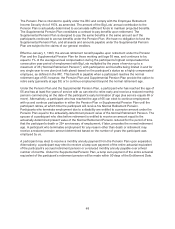

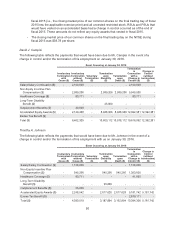

For purposes of calculating benefits under the Pension Plan, compensation is defined to include the

monthly equivalent of the total cash remuneration paid for services rendered during a plan year prior to

salary reductions pursuant to Sections 401(k) or 125 of the IRC, including bonuses. The table below

illustrates the amount of annual benefits payable at age 65 to a person with the specified five year

average compensation and years of service under the Pension Plan combined with the Supplemental

Pension Plan; assuming working to age 65.

Final Average

Compensation

Years of Service

10 15 20 25

$100,000 $10,000 $15,000 $20,000 $25,000

$125,000 $12,500 $18,750 $25,000 $31,250

$150,000 $15,000 $22,500 $30,000 $37,500

$175,000 $17,500 $26,250 $35,000 $43,750

$200,000 $20,000 $30,000 $40,000 $50,000

$225,000 $22,500 $33,750 $45,000 $56,250

$250,000 $25,000 $37,500 $50,000 $62,500

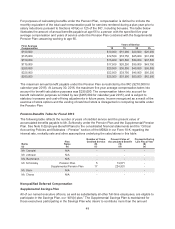

The maximum annual benefit payable under the Pension Plan is restricted by the IRC ($210,000 for

calendar year 2015). At January 30, 2016, the maximum five year average compensation taken into

account for benefit calculation purposes was $255,000. The compensation taken into account for

benefit calculation purposes is limited by law ($265,000 for calendar year 2015), and is subject to

statutory increases and cost-of-living adjustments in future years. Income recognized as a result of the

exercise of stock options and the vesting of restricted stock is disregarded in computing benefits under

the Pension Plan.

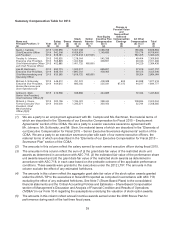

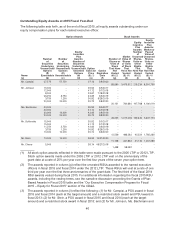

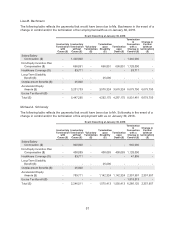

Pension Benefits Table for Fiscal 2015

The following table reflects the number of years of credited service and the present value of

accumulated benefits payable to Mr. Schlonsky under the Pension Plan and the Supplemental Pension

Plan. See Note 8 (Employee Benefit Plans) to the consolidated financial statements and the “Critical

Accounting Policies and Estimates – Pension” section of the MD&A in our Form 10-K regarding the

interest rate, mortality rate and other assumptions underlying the calculations in this table.

Name

Plan

Name

Number of Years

Credited Service

(#)

Present Value of

Accumulated Benefit

($)

Payments During

Last Fiscal Year

($)

(a) (b) (c) (d) (e)

Mr. Campisi N/A - - -

Mr. Johnson N/A - - -

Ms. Bachmann N/A - - -

Mr. Schlonsky Pension Plan 5 13,571 -

Supplemental Pension Plan 17 224,931 -

Mr. Stein N/A - - -

Mr. Chene N/A - - -

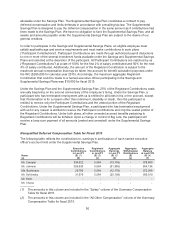

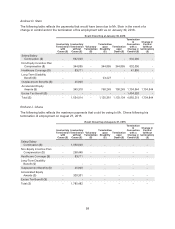

Nonqualified Deferred Compensation

Supplemental Savings Plan

All of our named executive officers, as well as substantially all other full-time employees, are eligible to

participate in the Savings Plan, our “401(k) plan.” The Supplemental Savings Plan is maintained for

those executives participating in the Savings Plan who desire to contribute more than the amount

49