Big Lots 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

54

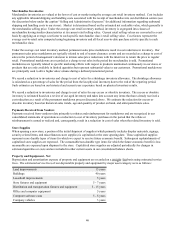

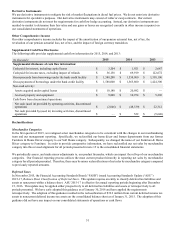

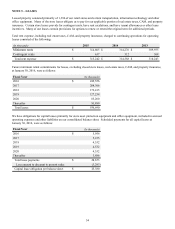

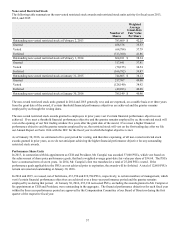

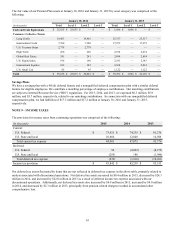

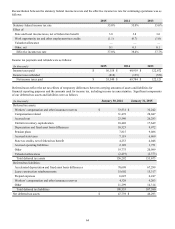

NOTE 5 – LEASES

Leased property consisted primarily of 1,394 of our retail stores and certain transportation, information technology and other

office equipment. Many of the store leases obligate us to pay for our applicable portion of real estate taxes, CAM, and property

insurance. Certain store leases provide for contingent rents, have rent escalations, and have tenant allowances or other lease

incentives. Many of our leases contain provisions for options to renew or extend the original term for additional periods.

Total rent expense, including real estate taxes, CAM, and property insurance, charged to continuing operations for operating

leases consisted of the following:

(In thousands) 2015 2014 2013

Minimum rents $ 314,605 $ 314,276 $ 309,935

Contingent rents 637 312 308

Total rent expense $ 315,242 $ 314,588 $ 310,243

Future minimum rental commitments for leases, excluding closed store leases, real estate taxes, CAM, and property insurance,

at January 30, 2016, were as follows:

Fiscal Year (In thousands)

2016 $ 249,556

2017 208,306

2018 172,415

2019 127,254

2020 85,260

Thereafter 93,899

Total leases $ 936,690

We have obligations for capital leases primarily for store asset protection equipment and office equipment, included in accrued

operating expenses and other liabilities on our consolidated balance sheet. Scheduled payments for all capital leases at

January 30, 2016, were as follows:

Fiscal Year (In thousands)

2016 $ 5,956

2017 5,235

2018 4,532

2019 4,532

2020 4,532

Thereafter 3,886

Total lease payments $ 28,673

Less amount to discount to present value (3,293)

Capital lease obligation per balance sheet $ 25,380