Big Lots 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

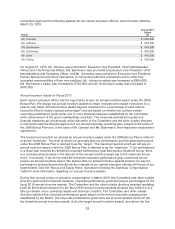

Executive Compensation Policies and Practices

Our executive compensation policies and practices support good governance and mitigate excessive

risk taking and include the following:

Policies and Practices Big Lots Policies and Practices

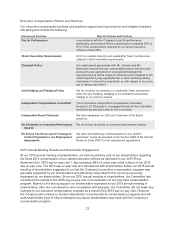

Pay for Performance In accordance with the Company’s pay-for-performance

philosophy, performance-linked compensation comprised 50% to

61% of the compensation awarded to our named executive

officers in fiscal 2015.

Stock Ownership Requirements All of our outside directors and Leadership Team members are

subject to stock ownership requirements.

Clawback Policy Our employment agreements with Mr. Campisi and Ms.

Bachmann provide that any compensation paid to the executive

pursuant to any agreement or arrangement between the

executive and us will be subject to deduction and clawback to the

extent required by any applicable law or stock exchange listing

requirement or any policy adopted by us with respect to any such

law or listing requirement.

Anti-Hedging and Pledging Policy We do not allow our directors or Leadership Team members to

enter into any hedging, pledging or monetization transactions

relating to our common shares.

Independent Compensation Consultant The Committee’s independent compensation consultant,

Exequity LLP (“Exequity”), is engaged directly by the Committee

and performs services solely for the Committee.

Independent Board Chairman We have separated our CEO and Chairman of the Board

positions.

No Dividends on Unearned Performance

Awards

We do not pay dividends on unearned performance awards.

No Excise Tax Gross-ups for Change-in-

Control Payments in our Employment

Agreements

We have eliminated any reimbursement for any “golden

parachute” excise tax imposed under Section 4999 of the Internal

Revenue Code (“IRC”) in our employment agreements.

2015 Annual Meeting Results and Shareholder Engagement

At our 2015 annual meeting of shareholders, we held an advisory vote of our shareholders regarding

the fiscal 2014 compensation of our named executive officers as disclosed in our 2015 Proxy

Statement (the “2015 say-on-pay vote”). Approximately 88% of votes cast voted in favor of our 2015

say-on-pay vote. The 2015 say-on-pay vote and discussions with shareholders before our 2015 annual

meeting of shareholders suggested to us that the Company’s executive compensation program was

generally supported by our shareholders and effectively responded to the concerns previously

expressed by our shareholders. Since our 2015 annual meeting of shareholders, the Committee has

considered the results of the 2015 say-on-pay vote in its evaluation of our executive compensation

program. Based on the strong support our shareholders expressed at our 2015 annual meeting of

shareholders, after due consideration and consultation with Exequity, the Committee did not make any

changes to our executive compensation program as a result of the 2015 say-on-pay vote. However,

the Company will continue to monitor shareholder concerns with its compensation programs and will

seek shareholder input to help understand any issues shareholders may have with the Company’s

compensation program.

23