Big Lots 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

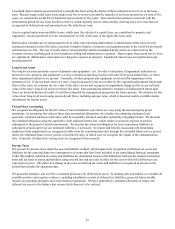

44

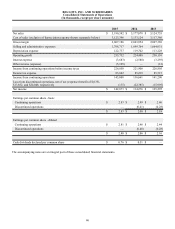

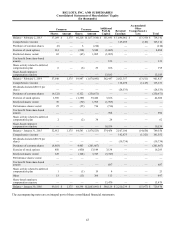

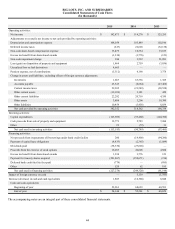

BIG LOTS, INC. AND SUBSIDIARIES

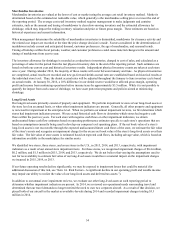

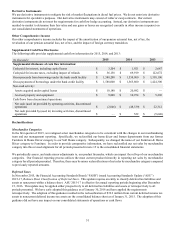

Consolidated Statements of Cash Flows

(In thousands)

2015 2014 2013

Operating activities:

Net income $ 142,873 $ 114,276 $ 125,295

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization expense 108,054 105,849 102,196

Deferred income taxes (617) 22,628 (32,138)

Non-cash share-based compensation expense 13,479 10,534 13,183

Excess tax benefit from share-based awards (1,330) (3,776) (123)

Non-cash impairment charge 386 3,532 21,091

Loss (gain) on disposition of property and equipment 1,464 2,759 (3,036)

Unrealized loss on fuel derivatives 4,665 — —

Pension expense, net of contributions (5,312) 4,190 3,378

Change in assets and liabilities, excluding effects of foreign currency adjustments:

Inventories 1,687 63,336 1,385

Accounts payable 23,345 (6,864) (27,468)

Current income taxes 29,305 (21,549) (28,538)

Other current assets (12,189) 3,181 420

Other current liabilities 22,282 20,718 4,350

Other assets 3,806 3,206 10,300

Other liabilities 10,454 (3,458) 8,039

Net cash provided by operating activities 342,352 318,562 198,334

Investing activities:

Capital expenditures (125,989) (93,460) (104,786)

Cash proceeds from sale of property and equipment 12,773 2,783 7,260

Other 23 (72) 31

Net cash used in investing activities (113,193) (90,749) (97,495)

Financing activities:

Net proceeds from (repayments of) borrowings under bank credit facility 200 (14,900) (94,200)

Payment of capital lease obligations (4,433) (2,365) (1,089)

Dividends paid (38,530) (27,828) —

Proceeds from the exercise of stock options 16,283 42,606 4,884

Excess tax benefit from share-based awards 1,330 3,776 123

Payment for treasury shares acquired (201,867) (250,671) (214)

Deferred bank credit facility fees paid (779) — (895)

Other 520 62 195

Net cash used in financing activities (227,276) (249,320) (91,196)

Impact of foreign currency on cash — 5,139 (1,595)

Increase (decrease) in cash and cash equivalents 1,883 (16,368) 8,048

Cash and cash equivalents:

Beginning of year 52,261 68,629 60,581

End of year $ 54,144 $ 52,261 $ 68,629

The accompanying notes are an integral part of these consolidated financial statements.