Big Lots 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

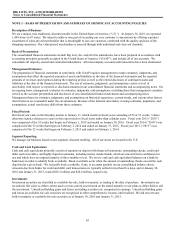

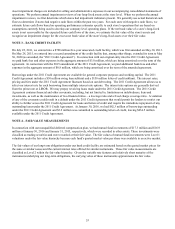

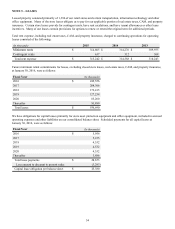

We recognize interest and penalties related to unrecognized tax benefits within the income tax expense line in the

accompanying consolidated statements of operations. Accrued interest and penalties are included within the related tax liability

line in the accompanying consolidated balance sheets.

The effective income tax rate in any period may be materially impacted by the overall level of income (loss) before income

taxes, the jurisdictional mix and magnitude of income (loss), changes in the income tax laws (which may be retroactive to the

beginning of the fiscal year), subsequent recognition, de-recognition and/or measurement of an uncertain tax benefit, changes

in a deferred tax valuation allowance, and adjustments of a deferred tax asset or liability for enacted changes in tax laws or

rates.

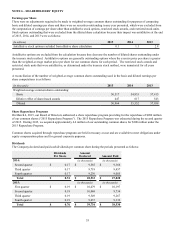

Pension

Pension assumptions are evaluated each year. Actuarial valuations are used to calculate the estimated expenses and obligations

related to our pension plans. We review external data and historical trends to help determine the discount rate and expected

long-term rate of return. Our objective in selecting a discount rate is to identify the best estimate of the rate at which the

benefit obligations would be settled on the measurement date. In making this estimate, we review rates of return on high-

quality, fixed-income investments available at the measurement date and expected to be available during the period to maturity

of the benefits. This process includes a review of the bonds available on the measurement date with a quality rating of Aa or

better. The expected long-term rate of return on assets is derived from detailed periodic studies, which include a review of

asset allocation strategies, anticipated future long-term performance of individual asset classes, risks (standard deviations), and

correlations of returns among the asset classes that comprise the plan’s asset mix. While the studies give appropriate

consideration to recent plan performance and historical returns, the assumption for the expected long-term rate of return is

primarily based on our expectation of a long-term, prospective rate of return. Our prospective expectations on long-term rate of

return and discount rate were noticeably affected by the amendments to terminate our pension plans, as further discussed in

note 8.

Insurance and Insurance-Related Reserves

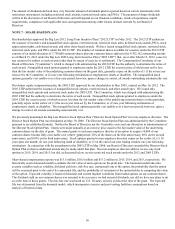

We are self-insured for certain losses relating to property, general liability, workers’ compensation, and employee medical,

dental, and prescription drug benefit claims, a portion of which is paid by employees. We purchase stop-loss coverage to limit

significant exposure in these areas. Accrued insurance-related liabilities and related expenses are based on actual claims filed

and estimates of claims incurred but not reported. The estimated accruals are determined by applying actuarially-based

calculations. General liability and workers’ compensation liabilities are recorded at our estimate of their net present value,

using a 4% discount rate, while other liabilities for insurance-related reserves are not discounted.

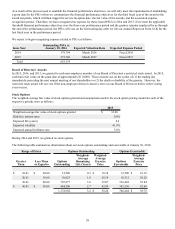

Fair Value of Financial Instruments

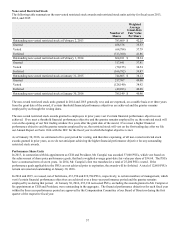

The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy, as defined

below, gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities and the lowest

priority to unobservable inputs.

Level 1, defined as observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2, defined as observable inputs other than Level 1 inputs. These include quoted prices for similar assets or liabilities

in an active market, quoted prices for identical assets and liabilities in markets that are not active, or other inputs that

are observable or can be corroborated by observable market data for substantially the full term of the assets or

liabilities.

Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its

own assumptions.

The carrying value of cash equivalents, accounts receivable, accounts payable, and accrued expenses approximates fair value

because of the relatively short maturity of these items.

Commitments and Contingencies

We are subject to various claims and contingencies including legal actions and other claims arising out of the normal course of

business. In connection with such claims and contingencies, we estimate the likelihood and amount of any potential obligation,

where it is possible to do so, using management's judgment. Management uses various internal and external specialists to assist

in the estimating process. We accrue, if material, a liability if the likelihood of an adverse outcome is probable and the amount

is estimable. If the likelihood of an adverse outcome is only reasonably possible (as opposed to probable), or if it is probable

but an estimate is not determinable, disclosure of a material claim or contingency is made in the notes to our consolidated

financial statements and no accrual is made.