Big Lots 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

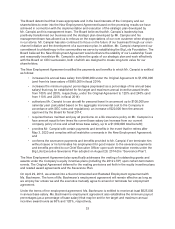

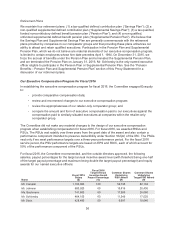

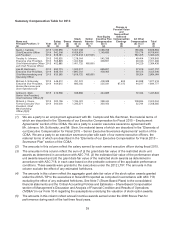

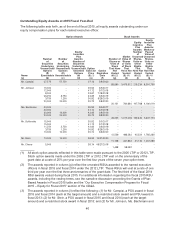

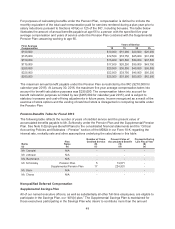

Summary Compensation Table for 2015

Name and

Principal Position (1) Year

Salary

($) (2)

Bonus

($)

Stock

Awards

($) (3)

Option

Awards

($) (4)

Non-Equity

Incentive Plan

Compensation

($) (5)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($) (6)(7)

Total

($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j)

David J. Campisi, 2015 1,034,656 - 5,307,038 - 2,089,206 - 196,084 8,626,984

Chief Executive Officer

and President

2014 942,308 - 6,458,624 - 1,149,690 - 155,778 8,706,400

2013 678,461 - 2,714,418 1,407,945 - - 562,405 5,363,229

Timothy A. Johnson,

Executive Vice President,

Chief Administrative Officer

and Chief Financial Officer

2015 543,935 - 1,218,004 - 545,266 - 49,404 2,356,609

2014 503,846 - 1,422,946 - 336,651 - 48,043 2,311,486

2013 452,885 - 1,401,725 485,600 - - 54,229 2,394,439

Lisa M. Bachmann, 2015 694,773 - 1,552,317 - 696,851 - 57,816 3,001,757

Executive Vice President,

Chief Merchandising and

Operating Officer

2014 646,154 - 1,892,202 - 429,065 - 58,125 3,025,546

2013 620,385 - 1,818,725 485,600 - - 39,354 2,964,064

Michael A. Schlonsky, 2015 446,312 - 761,574 - 408,089 605 60,838 1,677,418

Executive Vice President,

Human Resources and

Store Operations (8)

2014 404,615 - 883,032 - 225,541 87,072 44,517 1,644,777

Andrew D. Stein,

Senior Vice President,

Chief Customer Officer (8)

2015 413,538 - 636,886 - 344,885 50,334 1,445,643

Richard J. Chene, 2015 302,156 - 1,194,074 - 298,440 - 208,634 2,003,304

Former Executive Vice

President, Chief

Merchandising

Officer (8)(9)

2014 500,000 - 1,345,571 - 330,050 - 32,744 2,208,365

(1) We are a party to an employment agreement with Mr. Campisi and Ms. Bachman, the material terms of

which are described in the “Elements of our Executive Compensation for Fiscal 2015 – Employment

Agreements” section of the CD&A. We are a party to a senior executive severance agreement with

Mr. Johnson, Mr. Schlonsky, and Mr. Stein, the material terms of which are described in the “Elements of

our Executive Compensation for Fiscal 2015 – Senior Executive Severance Agreements” section of the

CD&A. We are a party to an executive severance plan with each of our named executive officers, the

material terms of which are described in the “Elements of our Executive Compensation for Fiscal 2015 –

Severance Plan” section of the CD&A.

(2) The amounts in this column reflect the salary earned by each named executive officer during fiscal 2015.

(3) The amounts in this column reflect the sum of (i) the grant date fair value of the restricted stock unit

awards as determined in accordance with ASC 718, (ii) the estimated fair value of the performance share

unit awards issued and (iii) the grant date fair value of the restricted stock awards as determined in

accordance with ASC 718, in each case based on the probable outcome of the applicable performance

conditions. These awards were granted to the executives under the 2012 LTIP. The amounts in this

column exclude the effect of any estimated forfeitures.

(4) The amounts in this column reflect the aggregate grant date fair value of the stock option awards granted

under the 2012 LTIP to the executives in fiscal 2013 reported as computed in accordance with ASC 718,

excluding the effect of any estimated forfeitures. See Note 7 (Share-Based Plans) to the consolidated

financial statements and the Critical Accounting Policies and Estimates – Share-Based Compensation

section of Management’s Discussion and Analysis of Financial Condition and Results of Operations

(“MD&A”) in our Form 10-K regarding the assumptions underlying the valuation of stock option awards.

(5) The amounts in this column reflect annual incentive awards earned under the 2006 Bonus Plan for

performance during each of the last three fiscal years.

39