Albertsons 2016 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2016 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

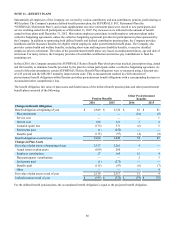

The Company’s participation in these plans is outlined in the table below. The EIN-Pension Plan Number column provides the

Employer Identification Number (“EIN”) and the three-digit plan number, if applicable. Unless otherwise noted, the most

recent Pension Protection Act (“PPA”) zone status available in 2016 and 2015 relates to the plans’ two most recent fiscal year-

ends. The zone status is based on information that the Company received from the plan and is certified by each plan’s actuary.

Among other factors, red zone status plans are generally less than 65 percent funded and are considered in critical status, plans

in yellow zone status are less than 80 percent funded and are considered in endangered or seriously endangered status, and

green zone plans are at least 80 percent funded. The FIP/RP Status Pending/Implemented column indicates plans for which a

funding improvement plan (“FIP”) or a rehabilitation plan (“RP”) is either pending or has been implemented by the trustees of

each plan.

Certain plans have been aggregated in the All Other Multiemployer Pension Plans line in the following table, as the

contributions to each of these plans are not individually material. None of the Company’s collective bargaining agreements

require that a minimum contribution be made to these plans. Multiemployer pension plan contributions and participants were

generally comparable for fiscal 2016, 2015 and 2014.

At the date the financial statements were issued, Forms 5500 were generally not available for the plan years ending in 2015.

The following table contains information about the Company’s multiemployer plans:

EIN—

Pension

Plan

Number

Plan

Month/

Day

End Date

Pension

Protection Act

Zone Status

FIP/RP

Status

Pending/

Implemented

Contributions Surcharges

Imposed(1) Amortization

ProvisionsPension Fund 2016 2015 2016 2015 2014

Minneapolis Food

Distributing

Industry Pension

Plan 416047047

-001 12/31 Green Green Implemented $ 10 $ 10 $ 9 No Yes

Central States,

Southeast and

Southwest Areas

Pension Fund 366044243

-001 12/31 Red Red Implemented 8 8 8 No No

Minneapolis Retail

Meat Cutters and

Food Handlers

Pension Fund 410905139

-001 2/28 Green Yellow Implemented 9 7 8 No No

UFCW Unions and

Participating

Employers Pension

Fund 526117495

-002 12/31 Red Red Implemented 5 4 4 Yes No

Western Conference

of Teamsters

Pension Plan 916145047

-001 12/31 Green Green No 4 4 3 No No

UFCW Union Local

655 Food

Employers Joint

Pension Plan 436058365

-001 12/31 Green Green No 2 2 2 No No

UFCW Unions and

Employers Pension

Plan 396069053

-001 10/31 Red Red Implemented 2 1 2 Yes No

All Other

Multiemployer

Pension Plans(2) 333

Total $ 43 $ 39 $ 39

(1) PPA surcharges are 5 percent or 10 percent of eligible contributions and may not apply to all collective bargaining agreements or total contributions to

each plan.

(2) All Other Multiemployer Pension Plans includes 11 plans, none of which is individually significant when considering the Company's contributions to

the plan, severity of the underfunded status or other factors.